What is the Bill of Exchange?

A bill of exchange is an unconditional order to ask money from the drawer to another party, requiring to pay a fixed amount of money, on demand or at a predetermined date. Bills of exchange are similar to checks and promissory notes – they can be drawn by individuals or banks, and usually be transferred by endorsements.

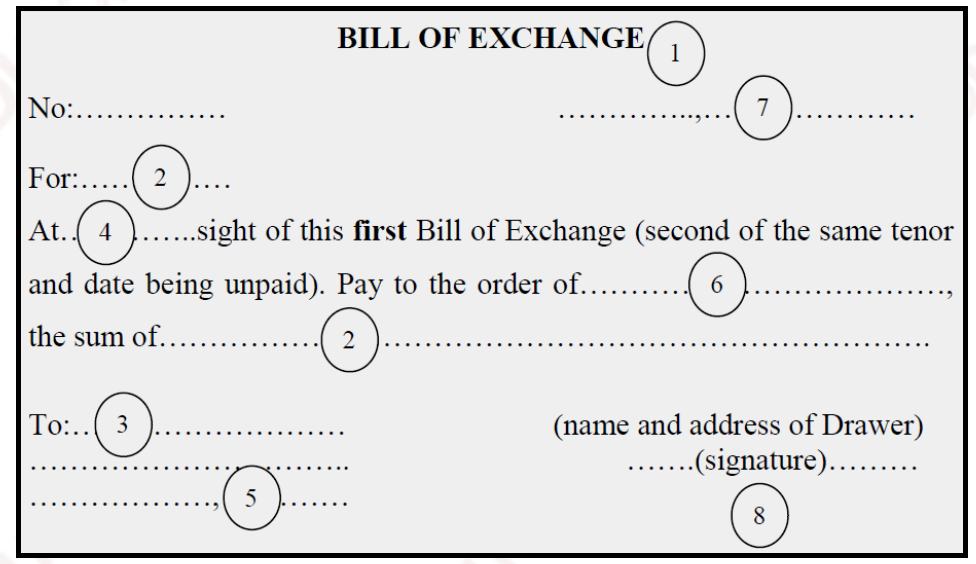

Contents on the bill of exchange

Bill of exchange title

The title of the bill must have the word “Bill of Exchange”, sometimes abbreviated as “Exchange” or “Draft”. If the title is written in English, the entire bill of exchange must be in English.

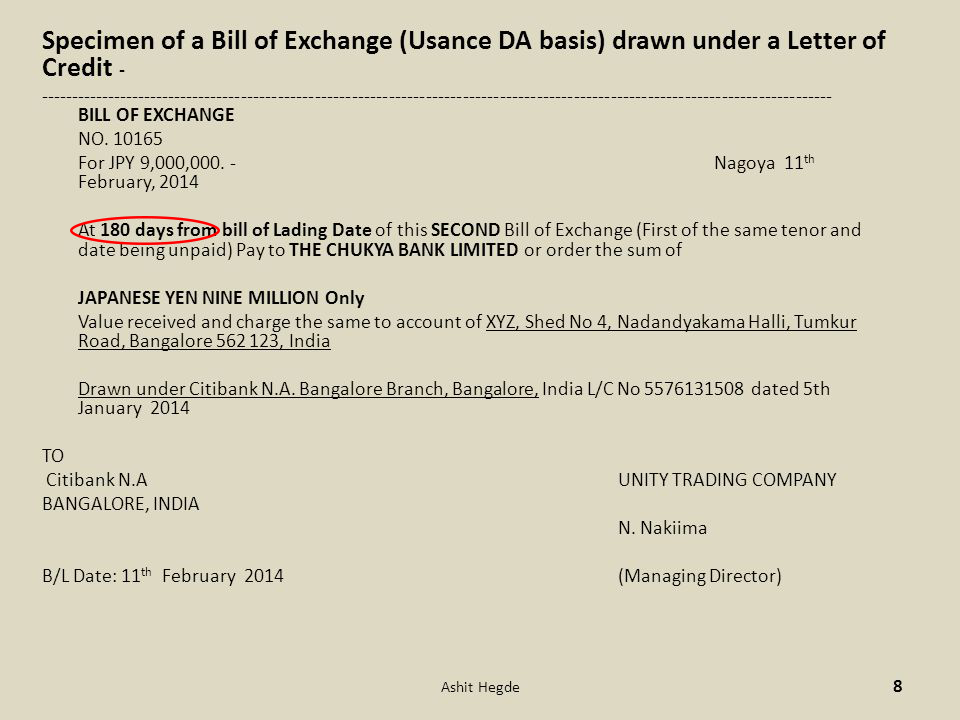

Amount and currency

This amount is recorded clearly and written in both numbers and words in the upper left corner of the bill of exchange “For…”. Notice that the amount on the draft can not exceed the amount stated on the invoice and in the letter of credit (L/C).

The drawee of the bill

The full name and address of the drawee must be clearly indicated, inscribed in the line of the word “To …”. In the collection payment method, the drawee is the importer and it is L/C issuing bank when using L/C payment method.

Term of the bill of exchange

The term of a bill of exchange can be stated either at sight or usance.

In the form of payment at sight, the bill of exchange will indicate “at … sight of this FIRST (SECOND) Bill of Exchange”.

As for usance methods, there are many ways to deal:

- Pay at a certain date after seeing the bill of exchange (At…X days…after sight of this……).

- Pay at a specified date after the date of drawing the draft (At …X days…after signed of this……).

- Pay at a certain date after the date of signing of the bill of lading (At….X days….after bill of lading date of this……).

- Pay at a certain date after the delivery date (At…X days…after shipment date of this……).

- Pay at a specific date in the future (On…(date)…of this……).

Place of payment

The address of the drawee is considered as the place of payment. However, if another place of payment is specified on the bill, it is referred to as the place of payment.

Beneficiary of bill of exchange

The beneficiary may be the drawer, or another person nominated by the drawer, or anyone to whom the draft has been transferred by the beneficiary.

Place and date of the bill of exchange

Place of issuing: in the country of the issuer (exporter).

Draft date: not earlier than the invoice date, the L/C opening date and within the validity period of the L/C.

Drawer of bills of exchange

The name, address, and signature of the drawer are obliged to be written on the draft. Valid signatures must be handwritten.

The rights and obligations of the parties

- Drawer: the person who prepares and issue the bill of exchange

- Drawee: the person responsible for paying the amount of money stated on the bill.

- Acceptor: the person signing acceptance to pay the bill.

- Beneficiary: the legal owner of the bill of exchange and therefore entitled to be paid for the amount stated on the bill.

- Assignor: the person who transfers the right to benefit from the bill of exchange to another person by hand or by endorsement.

- Avaliseur: the third party who signs on the bill of exchange in order to guarantee the ability to pay the amount stated.

Characteristics of a bill of exchange

A bill of exchange has three basic characteristics as follow:

- Abstraction: on the bill of exchange, it’s unnecessary to show the reasons or causes for the trade between parties.

- Mandatory paid: bill of exchange is considered an unconditional order. The payer must pay the right amount of money to the beneficiary without any excuses.

- Circulatability: This circulation is implemented through the transfer process (handing or endorsing).

Minh Ngô

Read more: Payment Methods Used In International Trade (Part 1)