HIGHLIGHTS

- According to Bloomberg, the Chinese government has limited the increase in electricity production, regulated by a planning mechanism without following the objective principles of the market.

- Thermal coal prices in China nearly tripled from early 2021 to mid-October, hitting record historic highs.

- According to the Global Times, China is currently looking to import coal from Russia and Mongolia, two countries that are geographically closer to China than Australia.

FULL ARTICLE

China has faced many unexpected challenges, the most recent of which is the severe power shortage energy crisis. According to the Lantou Group’s September 28 report, the most severely affected provinces, such as Xinjiang, Qinghai, Yunnan, Jiangsu, Fujian, Guangxi and Guangdong, are concentrated in large Chinese manufacturing companies.

The entire electrical system of China is owned by the state grid corporation State Grid. Although Beijing is still leading the world in large hydropower projects or clean energy sources from wind and solar, China’s electricity is still heavily dependent on coal, with an estimated three-quarter of electricity consumed being produced from coal-fired power.

Power crisis originated from…

According to Bloomberg, the Chinese government has limited the increase in electricity production, regulated by a planning mechanism without following the objective principles of the market, to prove Beijing’s determination to reduce emissions. China’s goal is that electricity use should grow at a rate slower than GDP. However, in the first half of this year, electricity use increased by 16.2%, while GDP grew by 12.7%. Notably, GDP is guessed to decline in the second half of the year, while electricity demand in winter tends to be higher. Beijing is willing to sacrifice economic growth to reform its economic structure in many areas.

Thermal coal prices in China nearly tripled from early 2021 to mid-October, hitting record historic highs. After Beijing implemented aggressive interventions, coal prices have declined, however, they are still 200% higher than in the same period a year ago. Some experts predict that the price of thermal coal will continue to rise again without stronger measures. Coal prices increased, but electricity prices remained low, leading to conflicts between coal miners and thermal power plants. Some coal-fired power plants were forced to close for “maintenance”, essentially to avoid losses. This further contributes to the exacerbation of the energy crisis in China.

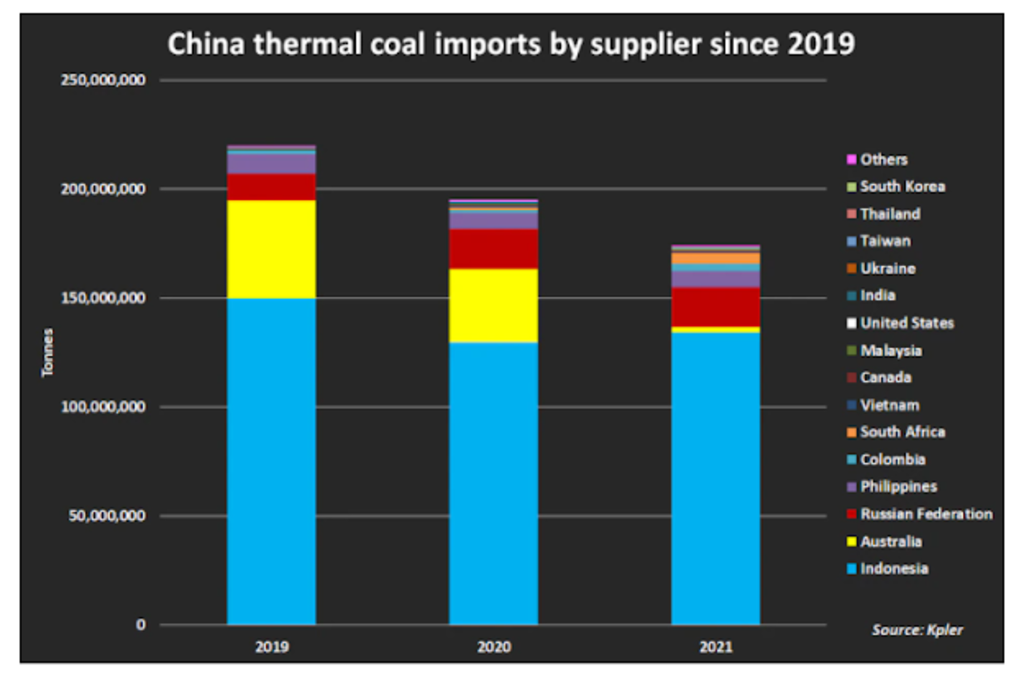

Notably, the China-Australia trade war has also dealt a heavy blow to coal exports in Australia, China’s second-largest coal exporter after Indonesia. Australia exported 35 million tons of thermal coal to China in 2020 and nearly 50 million tons in 2019. After the sanctions, coal export output was almost zero, with only a few being discharged from ports due to delays in customs clearance.

The reopening of many regions around the world increases the demand for production in China to serve exports, leading to a spike in electricity consumption. The problem of port congestion causes the import and export of goods to be delayed, thermal coal is not out of the list. Congestion, sea freight rates, and a shortage of containers contribute to the high price of thermal coal.

All of this creates new opportunities for countries in the region, especially in East Asia and Northeast Asia, and they also pose the problem of finding new sources due to the shortage of coal supply and rising coal prices.

Chinese authorities are trying to find new sources of supply

Currently, the central and local governments in China are actively looking for solutions to the domestic energy shortage before winter, especially in the northeastern provinces of the country, which will have to face sub-zero colds in the coming months.

As global coal prices continue to rise, rising shipping costs and tariffs are deal breakers for China. Therefore, besides the largest supply from Indonesia, it is inevitable to encourage coal sourcing closer to China. According to the Global Times, China is currently looking to import coal from Russia and Mongolia, two countries that are geographically closer to China than Australia.

Russia, a major energy exporter, has been playing an integral part in the energy sectors of Mongolia and China. Most of Russia’s coal reserves are located near Northeast China, which means that importing coal from Russia can save a lot of transportation costs.

In the past year, Russia’s coal supply to China has witnessed a steady growth. In the first half of 2021, Russia exported 24.15 million tons of coal to China, up from just 16.2 million tons in the first six months of 2020, nearly a 50 percent increase. China imported about 3.7 million tons of thermal coal in September, up 28% compared to August and 230% higher than a year ago.

Mongolia, China’s other northern neighbor, is also a potential choice for its energy crisis. After the Chinese ban on Australian coal, Mongolia’s coal exports to China had grown by 17.17 percent. More recently, according to data from Mongolian Customs, from January to September, Mongolia’s coal exports totalled 11.9 million tons, of which 11.3 million tons were exported to China, accounting for about 95 percent of the total.

As for Mongolia, coal exports and the mining industry at large will continue to be the country’s primary source of investment and business. This is an opportunity that cannot be missed, especially considering Mongolia’s slow economic growth and prolonged problematic deal with Rio Tinto.

With an abundance of coal supplies, Mongolia and Russia are not only two important partners with the heavy manufacturing industry, but also strategically important in both economic and political aspects with China.

Hong Dao