HIGHLIGHTS

- LPI (Logistics Performance Index) is a World Bank index that ranks the effectiveness and capacity of states’ logistics activities.

- The LPI has two component indicators: international LPI and domestic LPI.

- According to the World Bank’s 2018 Logistics Performance Index (LPI) Investigation Report, Vietnam placed 39th out of 160 examined countries.

- In addition, Vietnam is the top country in emerging markets and the highest-ranking country in the category of low-middle-income countries.

FULL ARTICLE

Indicator for assessing logistics performance and capacity (LPI)

LPI (Logistics Performance Index) is a World Bank index that ranks the effectiveness and capacity of states’ logistics activities. The Logistics Performance Index (LPI) is calculated utilizing surveys of logistics service providers (including freight forwarding and transportation).

This indicator is calculated every two years and is determined in even years. So date, six LPI ratings have been released: in 2007, 2010, 2012, 2014, 2016, and 2018.

Criteria for LPI assessment

Because logistics is considered as a network of services that supports the transportation of goods, cross-border commerce, and domestic trade, the LPI has two component indicators: international LPI and domestic LPI.

The international LPI is assessed based on six criteria:

Infrastructure: Transport and trade infrastructure quality (infrastructure of seaports, airports, railways, roads, sea, aviation, means of transport, warehousing, information technology infrastructure and IT services).

International Shipments: How simple it is to arrange for competitive transportation of import and export goods, including charges such as agency fees, port fees, tolls, storage fees, etc.

Logistics Competence: Capacity and quality of logistics service providers, such as organizations offering road, rail, air, sea, and multimodal transport services; warehousing and distribution businesses; delivery agents; customs offices; trade and transportation associations; delivery and receiver, etc.

Tracking and Tracing: The capacity to save, track and trace shipping data.

Timeliness: The schedule of shipments when they arrive at their destination in comparison to the stipulated time limit: export and import shipments complete customs clearance processes and arrive on time.

Customs: The efficacy of border control agencies, such as the speed, simplicity, and predictability of customs clearance procedures.

A weighted average of six evaluation criteria for a country’s logistics system on a scale of 1 to 5.

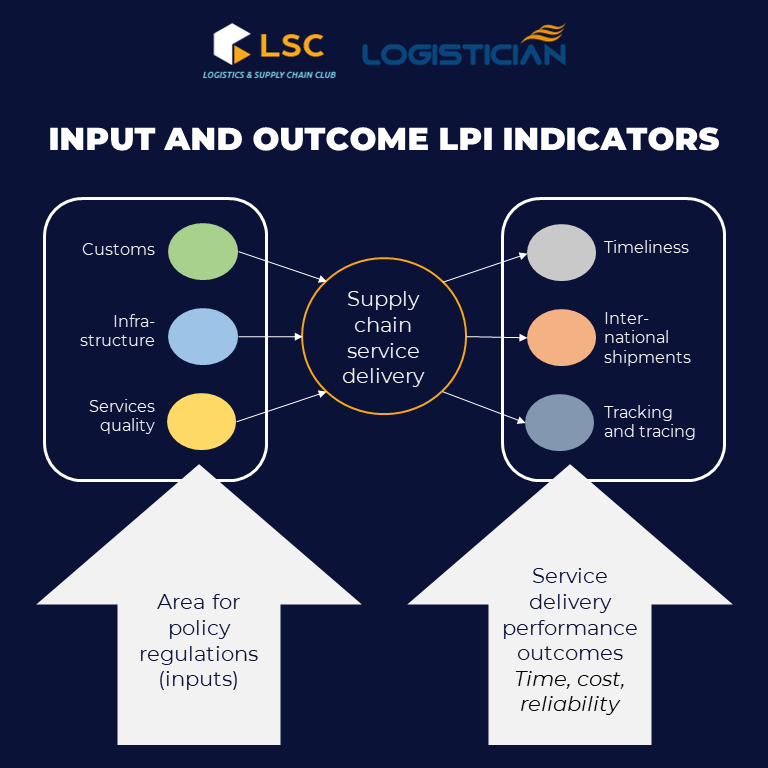

The six criteria of the international LPI can be divided into two groups:

- Supply chain inputs: indicators related to procedures and policies (Clearance, Infrastructure, Logistics service capacity).

- Supply chain output: indicators of time, cost and reliability (Time, International Transport and Retrievability).

The World Bank does not rate the domestic LPI index and instead simply offers statistical data for four criteria:

- Infrastructure: Transport and trade infrastructure quality (infrastructure of seaports, airports, railways, roads, sea, aviation, means of transport, warehousing, information technology infrastructure and IT services).

- Services: The capacity and level of growth of logistics service providers.

- Procedures and time for completing procedures at the border: Customs procedures and specialized inspection.

- Supply chain reliability: The responsiveness of domestic logistics service providers.

LPI rankings throughout the world over the years

There have been six LPI rankings so far: in 2007, 2010, 2012, 2014, 2016, and 2018. In 2018, the top ten countries with the highest LPI in the world included eight European nations and two Asian ones, Japan and Singapore.

Germany has the world’s highest LPI index, with 4.20 points. This is not unexpected given that Germany is regarded as the best performing country in the sector of commercial logistics and has consistently remained at the top of the rankings for many years, specifically in the previous three evaluations. Sweden is second with 4.05 points, and Belgium is third with 4.04 points.

After numerous LPI rankings, it is apparent that the top ten nations with the highest LPI in the globe are all high-income countries, the majority of which are European countries. These are usually leading countries in supply chain development. It can be observed from the table of the Top 10 nations in the world with the highest LPI score in 2018 that the efficiency of logistics activities in some countries, such as Austria, Denmark, and Japan, has increased drastically over the years.

The top 20 are dominated by European countries, which account for 12 of the LPI rankings. Other countries in the top 20 include New Zealand, Hong Kong (China), the UAE, Canada, the United States, and Australia. Notably, the two important countries along the new Silk Road, China and Poland, were ranked 26th and 28th, respectively.

The world’s lowest LPI countries are all low- and middle-income African and isolated countries. These are countries that are highly impacted by armed conflict, natural disasters, political instability, or landlocked countries that face logistical and economic challenges while engaging in global supply chains. In the 2018 LPI rankings, Afghanistan had the lowest LPI in the world with 1.95 points, followed by Angola with 2.05 points and Brunei with 2.06 points. Niger, Sierra Leone and Eritrea are the other countries with LPIs below 2.1.

China has the highest LPI score in the group of upper-middle-income nations, with 3.61 points, ranking 26th. Thailand is ranked 32nd with 3.41 points, and South Africa is ranked 33rd with 3.38 points.

In the table of Top 10 countries with the highest LPI ranking in the group of low-middle-income countries, Vietnam has the country with the highest LPI index with 3.27 points, ranked 39/160. Following that are large economies such as India, Indonesia, Ivory Coast, Philippines, etc. Countries in this group are often those that border the sea or have advantageous geographical locations that serve as international transit ports.

Vietnam’s LPI ranking over the years

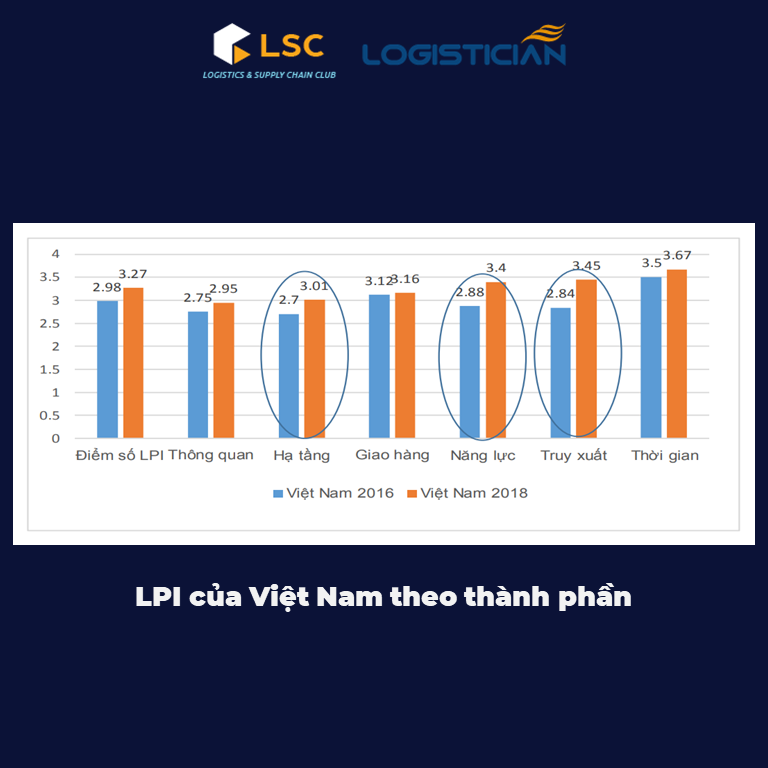

According to the World Bank’s 2018 Logistics Performance Index (LPI) Investigation Report, Vietnam placed 39th out of 160 examined countries, an increase of 0.29 points and 25 positions over the previous year. In addition, Vietnam is the top country in emerging markets and the highest-ranking country in the category of low-middle-income countries. In the ASEAN region, Vietnam ranks third, after Singapore (7th) and Thailand (32nd).

Tracking data from the World Bank (WB) across six evaluation periods reveal that the capacity of logistics activities in Vietnam has changed significantly. In particular, Vietnam’s LPI barely achieved 2.89 points in 2007, ranking 53rd in the world; nonetheless, Vietnam maintained this place in 2010 and 2012, with the score increasing slightly year over year. By 2014, Vietnam’s LPI index had risen to 3.15 points, up 0.15 points from 2012 and 0.26 points from 2007. The country was ranked 48th in the world.

From 2007 to 2014, the scores of the criterion all climbed sharply from 0.22 to 0.61 points, with the infrastructure indicator increasing the greatest, from 2.5 to 3.11 points. Only the customs clearance index fell from 2.89 points to 2.81 points.

In 2016, Vietnam’s LPI ranking fell to 64th place, with 2.98 points. Compared to 2014, 5 of the 6 criteria were reduced from 0.06 to 0.35 points this year.

The year 2018 was a turning point in Vietnam’s logistics industry. In 2018, the LPI assessment index clearly demonstrates the exceptional rise of the indicators for assessing the composition of logistics operations. For example, the ability to trace and trade items scored 34th, up 41 places from 2016, and the quality capacity of logistics services ranked 33rd, up 29 places from 2016.

Furthermore, additional factors contributed considerably to the growth in LPI scores in 2018, such as: via ranking 41, up 23 places, Logistics Infrastructure rated 47th, up 23 places, Delivery Time criterion ranked 40th, up 16 places, and International Delivery criteria ranked 49th, up one rank.

Therefore, with improved scores in all criteria, the logistics sector in Vietnam promises to grow strongly in the future as the use of information technology in the field of logistics increases in tandem with the Government’s economic reforms and corporate internal efforts. Furthermore, the logistics sector will continue to improve in order to meet the Action Plan’s goals of improving competitiveness and developing logistics services in Vietnam by 2025.

Huyen Tu