HIGHLIGHTS

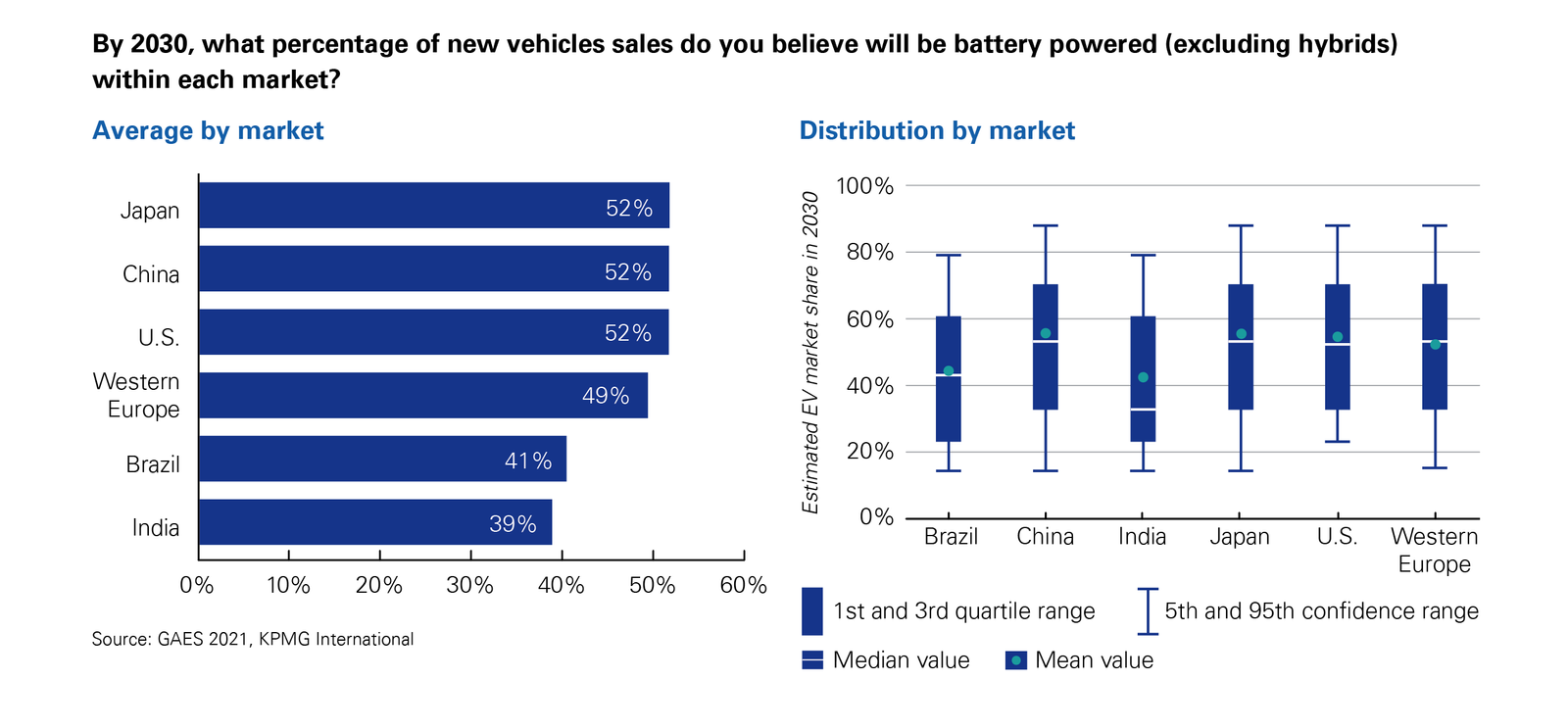

- According to survey data, auto business leaders expect electric vehicles to account for 52% of the market share in the US, China and Japan by 2030.

- The two largest car manufacturers in the world, Volkswagen AG and Toyota Motor did not agree to sign the statement.

- 31% of respondents believe startups will have a “huge impact” on the industry, while 8% believe most, if not all, will fail.

FULL ARTICLE

According to survey data, auto business leaders expect electric vehicles to account for 52% of the market share in the US, China and Japan by 2030 even without government subsidy programs. Besides, the electric vehicle market share in Western Europe, India and Brazil is also expected to grow at a slower rate in the coming years.

However, traditional internal combustion engines vehicles and gasoline-electric vehicles, including hybrids are forecast to still dominate the automotive market in the next few years.

There are a lot of conflicting opinions

Currently, the elimination of the internal combustion engine along with CO2 emissions is a top concern of the global auto industry. In early November, a group of car manufacturers and countries signed a joint statement, which set the goal of phasing out internal combustion engines vehicles in the developed world by 2035 and beyond, globally in 2040.

However, the two largest car manufacturers in the world, Volkswagen AG and Toyota Motor, along with the three largest car-consuming countries in the world as China, the United States and Germany, did not agree to sign the statement.

As for China, there are mixed opinions when it comes to the future of electric vehicles in the country. Some predict EVs will account for 80% of the market, while others predict EVs will only account for 30% of the Chinese market by 2030.

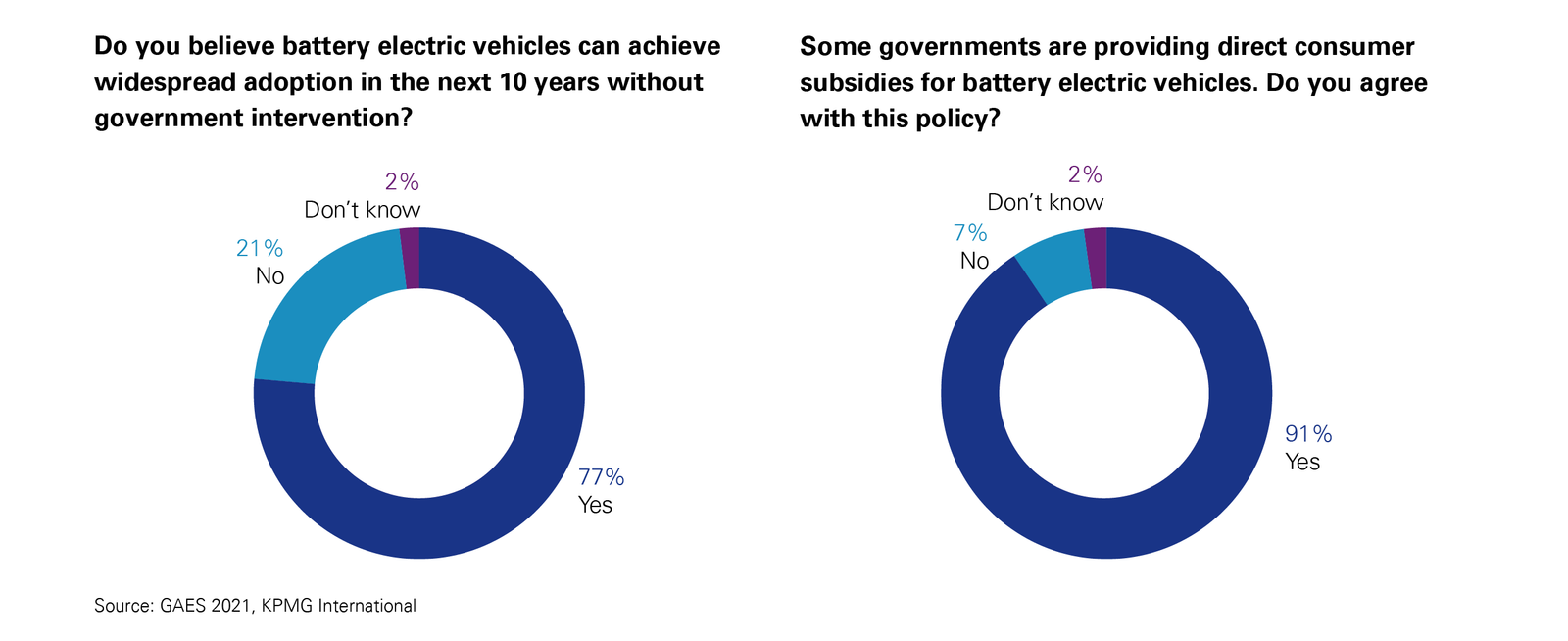

Currently, worldwide electric vehicle consumption is backed by government subsidies. But 77% of respondents to KPMG’s survey think electric vehicles could become widely available within 10 years without government support, as battery costs would fall to par with petrol engines. Otherwise, 91% of auto business leaders surveyed confirmed that they support the government’s supportive policy.

The survey also shows that 75% of auto business leaders expect their company to liquidate “non-core” assets in the coming years when they reassess possible business when more and more new cars switch to battery-electric technology.

The wave of electric car startups

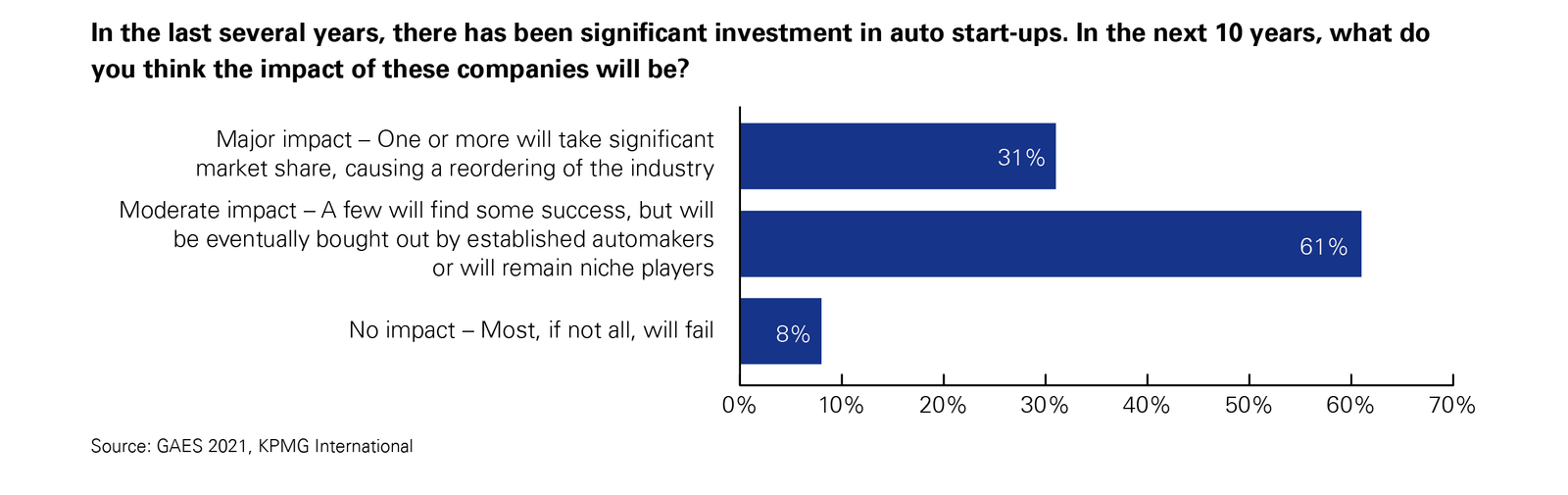

More than 60% of survey respondents believe that the new wave of electric vehicle startups entering the auto industry will have a “moderate impact” on the global market. That means a few will find success. Many will eventually get bought by larger companies or remain a niche player, according to the survey. “There will be a lot of mergers and acquisitions in the near future”, said Mr. Gary Silberg, a leader of KPMG.

31% of respondents believe startups will have a “huge impact” on the industry, while 8% believe most, if not all, will fail.

Although the survey did not name companies, a number of electric vehicle startups have entered the market recently. The most prominent is Rivian and Lucid, both of which are producing cars. Others like Canoo, Lordstown Motors and Fisker haven’t generated much (if any) revenue yet.

Despite the supply chain disruptions and epidemic situation over the past year, about 53% of automotive business leaders surveyed said they believe the industry can achieve profitable growth in the next 5 years.

Hong Đao

Xiaomi establishes an electric vehicle manufacturing company