HIGHLIGHTS

- Vietnam’s wind power plants have huge potential to become the export hubs of Southeast Asia.

- Wind power projects in Vietnam are facing many obstacles due to Covid-19, thus it is likely that they will not enjoy the preferential price mechanism.

- It will be a big shock to the investors in case the FIT price will not be extended.

FULL ARTICLE

Potential to develop

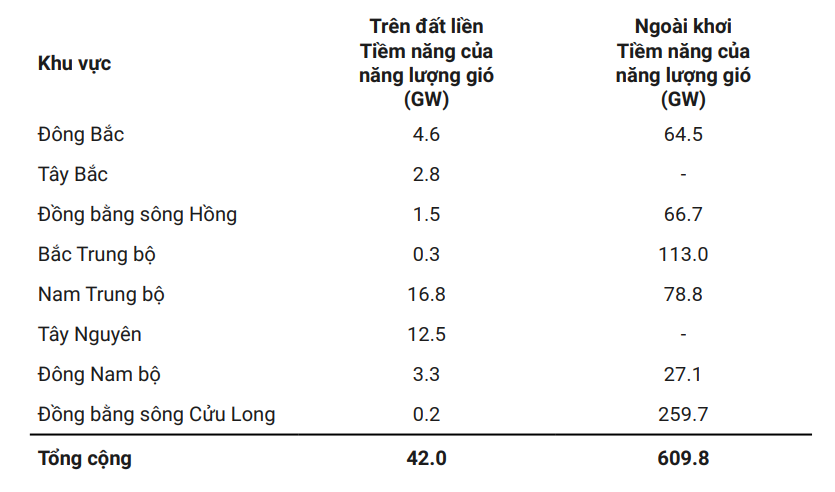

With the coastline stretching over 3000 km and humid subtropical climate, Vietnam has been assessed as having high wind potential in Southeast Asia. The construction of wind power plants here is a reasonable solution that will significantly increase electricity production capacity in the coming years.

“Vietnam has the potential to become the export hub of Southeast Asia in this sector. That can help increase the number of jobs in this area by 60%”, said Mr. Mark Leybourne, Senior Energy Specialist, World Bank.

Furthermore, replacing thermal power plants could reduce emitting more than 200 million tons of CO2 and bring at least $50 billion to the Vietnamese economy.

Wind power “missed appointment” with FIT

*Feed-in Tariff (FIT) is the supporting electricity tariff. It is a policy mechanism designed to accelerate investment in renewable energy technologies by offering long-term contracts to renewable energy producers.

Vietnam’s wind power onshore projects are forced to put into commercial operation before 31/10/2021 to apply a preferential price at 8.5 cents/kWh. However, according to the Global Wind Energy Council, about 50% of the projects submitted will not meet this deadline.

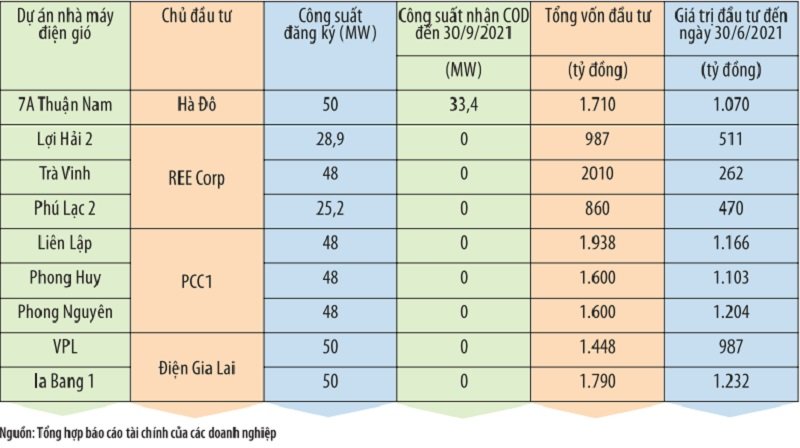

According to the Electricity of Vietnam (EVN), by the end of September 2021, only 6 out of 106 wind power plants registered for Commercial Operation Date (COD) testing were recognized for operation.

Recently, authorities have received a lot of proposals to extend the FIT validate time. The reason was supposed to be the Covid-19 pandemic, which led to the delay in the supply of wind turbines from abroad, the interruption of international commercial activities, prices increase of materials, etc. So many projects could not be completed in time.

However, the Ministry of Industry and Trade did not approve these proposals. Projects which will not be finished by 31/10 are not applied to FIT.

Big shock to the investors

“If the FIT price is not extended, the projects will face many difficulties in finance as well as the electricity selling after the FIT expires,” said Dr. Mai Duy Thien, Chairman of the Vietnam Clean Energy Association.

REE Corp is implementing 3 wind power projects with an investment of up to 1,060 billion VND. Gia Lai Power also raised the total construction cost of 3 wind power projects to 2,756 billion VND. However, none of their capacity has received COD yet.

The wind power industry was hit hard by the pandemic, not only in Vietnam, but also around the world. The prolonged schedule has cost a lot of money, threatening the financial ability of the project.

In addition, loan interest is also a matter of some concern. REE Corp’s loan liability is approximately 59%. Two projects of Gia Lai Electricity also used more than 910 billion VND of bank loans. The disruption will directly affect the cash flow of the businesses, which perhaps leads to the worst situation, insolvency.

Thanh Thao

FURTHER READING

Chinese power cuts may disturb US$120 billion of trade flows