Once again, the global supply chain is at risk

As the beginning of the pandemic, many landmark events and challenges have been relentlessly hitting the global supply chain. They come together to produce a perfect series of events that no one could have expected.

Several countries’ steady recovery from the pandemic last year led to a “purchasing boom”, which can be regarded as the cause of severe container shortage, resulting in delays in goods shipping from China to the EU or US. According to China International Maritime Container Corporation (CIMC), 20-feet container throughput has risen from 300,000 units (September 2020) to 440,000 units (January 2021). Despite that, the demand for goods delivery has yet not been met in the context that the worldwide container demand is estimated at about 180 million containers. Additionally, the container turnaround time has skyrocketed to 100 days (compared to 60 days – previously) exacerbating the container shortage situation. The container scarcity results in high transportation costs – a factor affecting the skyrocketing prices of all kinds of goods, causing negative effects on businesses as well as consumers.

On March 23, 2021, the Ever Given incident – one of the largest container ships in the world – got stuck in the Suez Canal and blocked the global trade route for nearly a week. It is estimated that about 12% of global trade passes through the Suez Canal, where an average of more than 50 ships pass through each day. The case has caused a global maritime transport crisis, disrupting $9.6 billion commercial activities each day.

Most recently, an outbreak of Covid-19 in Southern China prompted authorities to suspend handling operations at ports and implement strict measures to control the disease. This has disrupted port services and delayed deliveries, causing severe congestion in Southern ports such as Yantian and Nansha. With a throughput of 13.3 million TEUs last year, Yantian handles approximately 50% more cargo than the Port of Los Angeles – the busiest container port in the US. Many vessels are forced to wait at least 14 days to receive their goods, with an average of 25,500 TEUs of unhandled cargo every day and nearly 160,000 containers waiting to be unloaded. Severe congestion, rising shipping costs led to delays in shipping goods from China to Europe and the United States, once again disrupting global supply chains. According to experts, the impact of this crisis on the global supply chain is unlikely to be estimated.

In less than 1 year, 3 consecutive events have made ocean freight rates reaching record levels, accompanied by consequences of the global Covid-19 pandemic including: raw materials supply scarcity, production shutdown, the imbalance between market demand and supply, pushed commodity prices on the market higher, potentially posing risks of global inflation.

Price fluctuations on the global market

According to the fluctuations in commodity prices in many markets, the International Monetary Fund (IMF) projecte that inflation in the region of developed countries will increase in 2021 reaching 1.6%, up 0.9% compared to 2020 and continuing to increase to 1.7%. This forecast is up 0.3% and 0.2% respectively compared to the forecast in January 2021. For emerging and developing countries, inflation is forecasted to reach 4.9% in 2021. In which, the figure in the emerging and developing countries in Europe is 6.5%, up 1.1% compared to 2020 while that of Asia is 2.3% in 2021. The above inflation risks are reflected in the CPI.

The rising price of foodstuffs and agricultural products is first to mention:

In the United States, the prices of food items like bacon, fruits and cereal rose respectively 10.7%, 6.2% and 0.2%. This is also the country with the highest inflation rate since the 2008 economic crisis – reaching 4.2% in April 2021 (compared to 2.6% in March 2021 and 1.4% in January 2021). The IMF forecasts that inflation in the US will reach 2.3% in 2021, up 1.1% compared to 2020 and continue to increase to 2.4% in 2022. As for the European market, prices of food items in March rose 1.7% year-on-year. Specifically, bread and cereals increased by 1.1%, eggs and milk by 0.7%, fruits by 2.8%… other foods all tended to increase slightly. The price of wheat rose more than 19%, corn increased 30.6%, butter increased 12.1%.

Not only food, but most of the goods from oil, steel, or even ocean freight rates also rose to a record level.

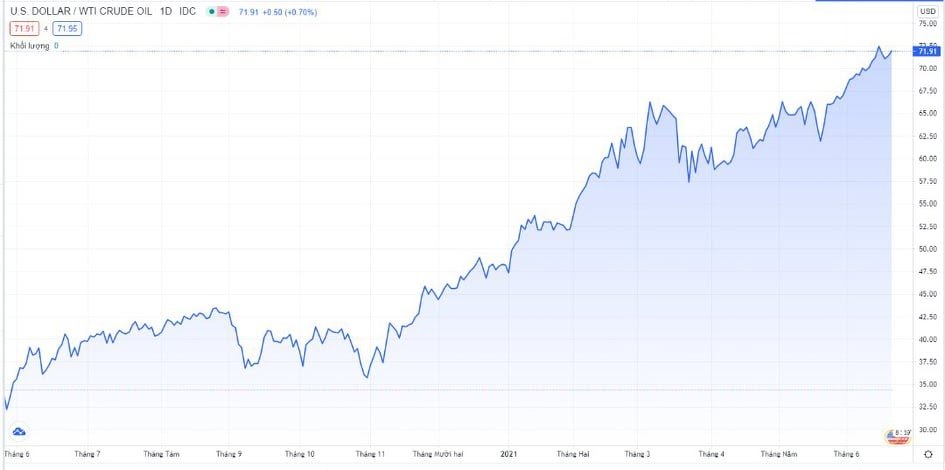

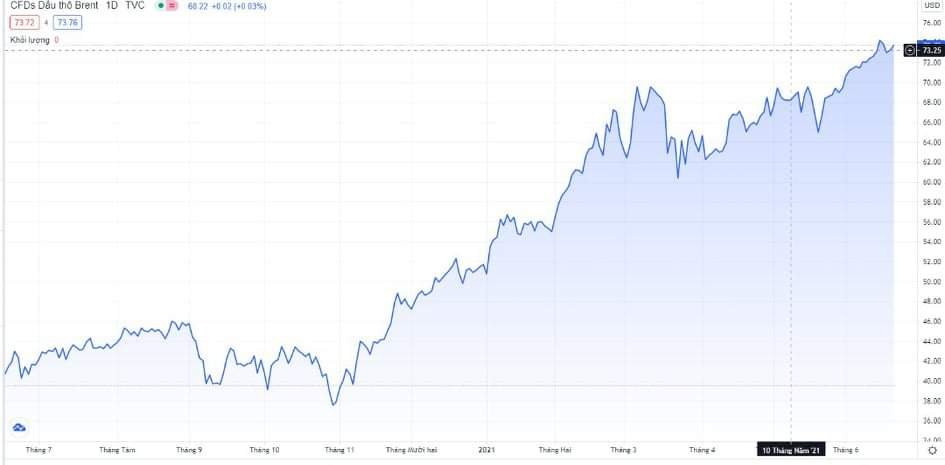

World crude oil prices continued to climb sharply to the highest level within the latest 2 years.. WTI oil traded above 71 USD/barrel, Brent oil is above 73 USD/barrel, both of which increased nearly 0.3% (on June 15) compared to the previous recorded prices. The two charts below illustrate the oil price volatility within a year.

The rising Iron ore and steel prices in China greatly affected global steel prices since China is the largest steel producer in the world. Along with higher logistics costs and a stronger yuan, the strong economic recovery after the pandemic, promotion in infrastructure investment has pushed steel prices to record level.

On the Shanghai Futures Exchange rebar prices with transaction terms to October 2021 which were traded on June 18 were increased by 0.3% to 5,101 CNY / ton, hot-rolled coil prices also increased by 0.3% to 5,371 CNY / ton. Rising prices of input materials leading to declining profit margins will force manufacturers in China to handover some of the increased costs on to overseas customers.

Ocean freight, specifically container freight rates, increased beyond control. According to data from Drewry Shipping, the cost to ship a 40-foot container by sea from Shanghai to Rotterdam has now hit a record of $10,522 – up 547% from the recent five-year average. Specifically, this price increased 3.1% compared to a previous week and increased 485% compared to a previous year. With approximately 80% of the world’s goods transported by sea, rising freight rates threaten to drive up the prices of every commodity. This makes the fear of inflation even more increasing in the context that inflation is under pressure from other several factors.

Domestic inflation pressures

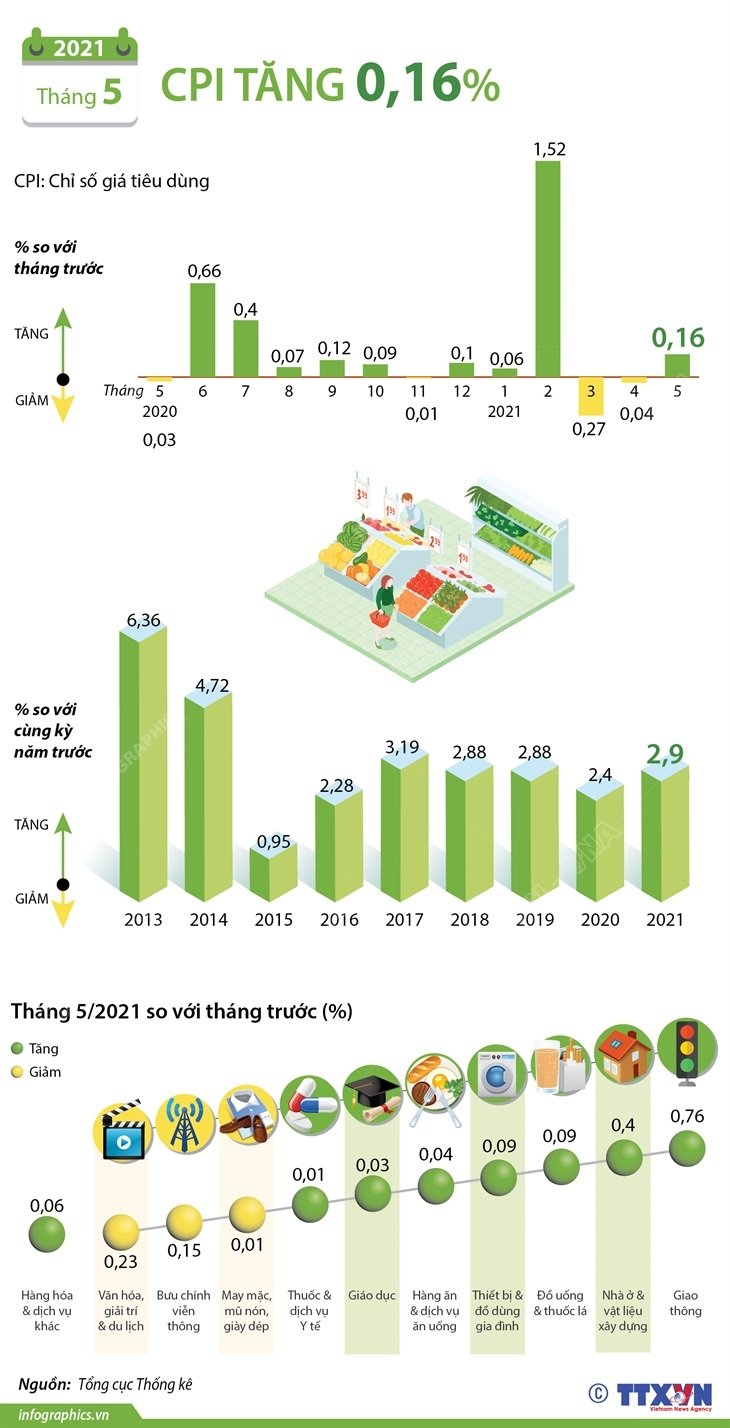

Vietnam is not out of the game, supply chain disruptions boost the prices and multiply potentially inflationary risks. According to data from the General Statistics Office, the consumer price index (CPI) continued to increase owing to the economic recovery as mentioned in the case of the global market. Specifically, the CPI in May 2021 increased by 0.16% compared to the previous month. Especially, the increase in traffic and housing & construction materials with 0.76% and 0.4% respectively.

Average CPI in the first 5 months of 2021 increased by 1.29% compared to that of 2020 (the lowest increase since 2016) with core inflation in 5 months increased by 0.82%. CPI in May 2021 increased by 1.43% compared to December 2020 and increased by 2.9% year-on-year.

The production price index (PPI) of iron and steel products has increased by 40.47% year-on-year. The world oil price is changing in a complicated way, in the first 5 months of 2021, it has increased by 60% compared to last year, while Vietnam still has to import a large amount of petroleum. Similarly, that 80-85% of animal feed is still imported will greatly impact on the price of cattle, poultry and aquatic products in the near future.

Furthermore, Vietnam will also be affected by the economic recovery policies of other countries such as loosening monetary policy, issuing many economic stimulus packages, reducing interest rates, etc. which will boost commodity prices. Simultaneously, the price control of many goods managed by the state according to the designed roadmap, such as medical services and education, will also affect this year’s CPI, thereby creating considerable pressure in controlling inflation.

In conclusion, consecutive events happening in a short period of time have had a significant impact on the already fragile global supply chain. One of its consequences mentioned in this insight is the inflation of the economy. Although rising inflation is inevitable because it reflects the recovery of the economy as well as brings certain benefits such as stimulating consumption, borrowing and investment; reducing unemployment rate; redistributing income, etc. However, that the inflation increase is higher than the economic growth for a long time without any restraining measures from the government is a totally different story. Some negative effects can be mentioned such as economic recession, unemployment rate increase and decrease in the level of real income of workers, etc.

Hong Dao