HIGHLIGHTS

- Shipping lines gain a lot of benefits from rising sea freight rates now and perhaps in the future.

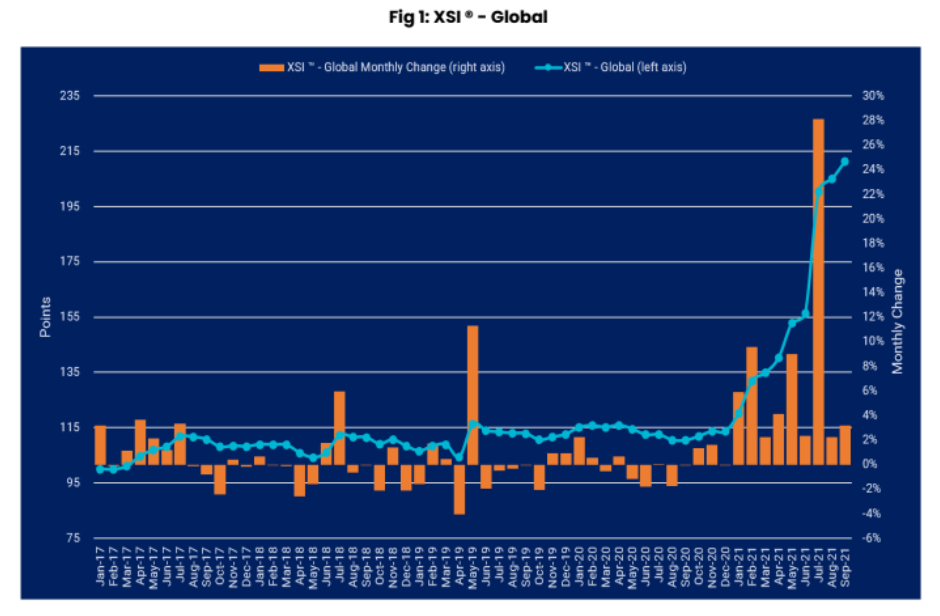

- The freight index (XSI) increased more than 90% over the first 9 months.

- Some big companies found new ways to face up to this unstable situation.

FULL ARTICLE

Freight increased, luck and pressure

The global XSI (Xeneta Shipping Index) increased by 3.2% in September to reach 211.39 points. This represented the ninth consecutive monthly increase and took the benchmark to 91.5% higher than the equivalent period last year and 86.1% higher than at the end of 2020.

*XSI is calculated by Xeneta based on data of more than 280 million freight contracts all over the world. XSI indicates the movement in the global container shipping market, especially in freight rates.

It can be seen that, Covid-19 pandemic brings luck to shipping lines. “This year has seen a unique convergence of Covid-19 disruption, port congestion, significant demand rise, that has stoked the flames of record-breaking rates,” explained the CEO of the Oslo-based company, Patrik Berglund.

The global supply chain is under intense pressure and shippers have no choice but to pay just to ensure deliveries date, especially before important occasions such as Christmas. Thus, shipping lines benefit from high freight rates with record financial results and promising forecasts for the upcoming period.

Hapag-Lloyd is one typical case when its profit increased ten times during the first half of the year. Likewise, the EBITDA of CMA CGM surged in the second quarter. Meanwhile, Maersk EBITDA was estimated to increase from $8.5-$10.5billionn to $22bn-$23billion.

**EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) is a measure of a company’s overall financial performance and is used as an alternative to net income in some circumstances. (Source: Investopedia)

Any opportunities for shippers?

According to Xeneta analysis, shippers are trying new strategies to avoid one-sided negotiations and retake a sense of control. There are several large companies, such as IKEA and Home Depot, which are chartering their own ships to face supply chain difficulties and control skyrocketing costs.

“This is a direct response to a market in overdrive, but one wonders if this type of approach could signify a new way of working, in the long-term, for shippers sick of being held to ransom,” said Berglund.

In general, companies are hard hit by the disruption in supply chain and changes in freight rates. However, Xeneta believes that carriers seem to have control of the situation with a growth of 7-8% in box volumes and around 400 newbuild container vessels having been ordered so far in 2021. That promises recovery in the upcoming days.

In this circumstance, shipping lines are trying to secure a huge avenue from rising sea freight rates by locking customers into longer-term contracts or even offering premium services which last some years.

In case of pre-deposit shippers, CMA CGM halts all spot rate hikes until next February. This movement was supposed to prioritize the relationship with customers in the unprecedented situation in this market.

The future of shipping market

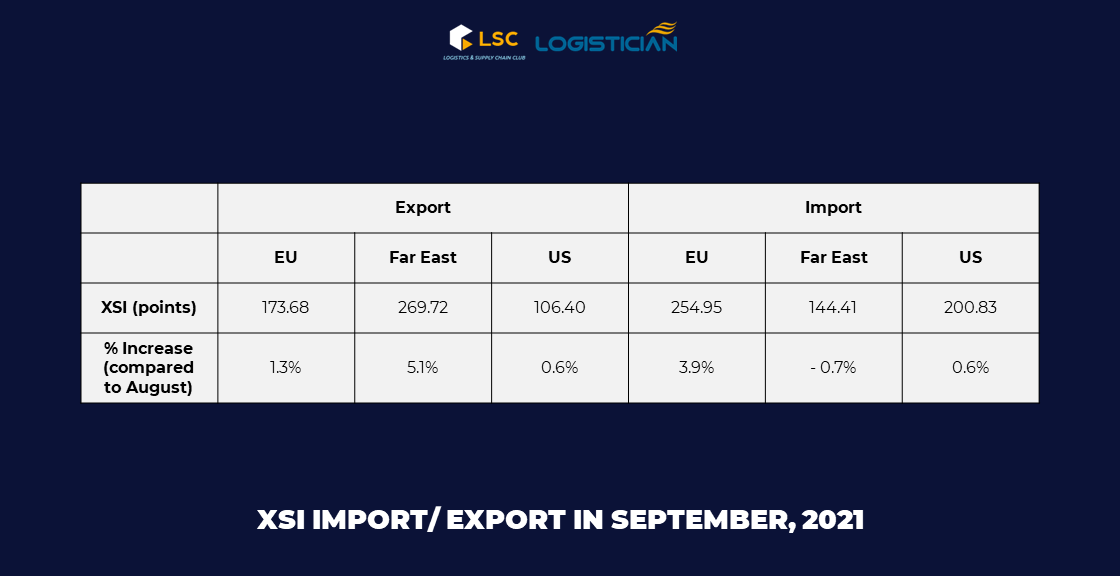

The latest XSI report provides a regional analysis of market forecasts from the data of the majority of big shippers.

The European imports freight index rose 3.9% in September, indicating a 132.5% increase in the benchmark year-on-year. Exports figure also increased by 1.3%, 51.7% higher than the same period last year.

For the Far East, imports fell for the first time since March, but only 0.7 percent. This still makes the index up 49.8% year-over-year. The export index was more favorable, up 5.1%. The year-over-year benchmark was up 126.8 percent in September, while it was up 113.6 percent since the end of 2020.

In addition, in the United States, imports rose slightly by 0.6 percent, although recent strong growth led to a 67.3% increase in the standard year-on-year. Exports increased by the same margin, with the index now a (relatively modest) 20.7% up, compared to the same period of 2020.

Meanwhile, port congestion remains high, especially in major hubs such as Los Angeles, Long Beach, New York and Hamburg, and equipment supplies are short. “Seen against strong pre-festive season demand, and stubbornly high spot rates, it’s difficult to see much relief on the horizon for shippers”, claimed Berglund.

Thanh Thao

FURTHER READING

Transparency of sea freight rates, avoiding “price blowing”