HIGHLIGHTS

- According to VITAS, overall textile and garment export turnover climbed by 13% in the first nine months of this year compared to the same time in 2020.

- Despite being afflicted by the COVID-19 outbreak for several months, the textile and apparel industry is nevertheless growing, according to VCBS.

- Vietnam will attract a large number of orders from significant partners engaged in global supply chain sustainability, such as H&M, Uniqlo, Nike, and Adidas.

FULL ARTICLE

Vietnam’s textile and garment market share in the US increases

Currently, Vietnam is the fourth largest garment exporter in the world market after China, the EU, and Bangladesh. According to the Vietnam Textile and Apparel Association (VITAS), in the first nine months of the year, the total export turnover of textiles and garments reached $29 billion, up 13% over the same period in 2020 and equivalent to the same period in 2019.

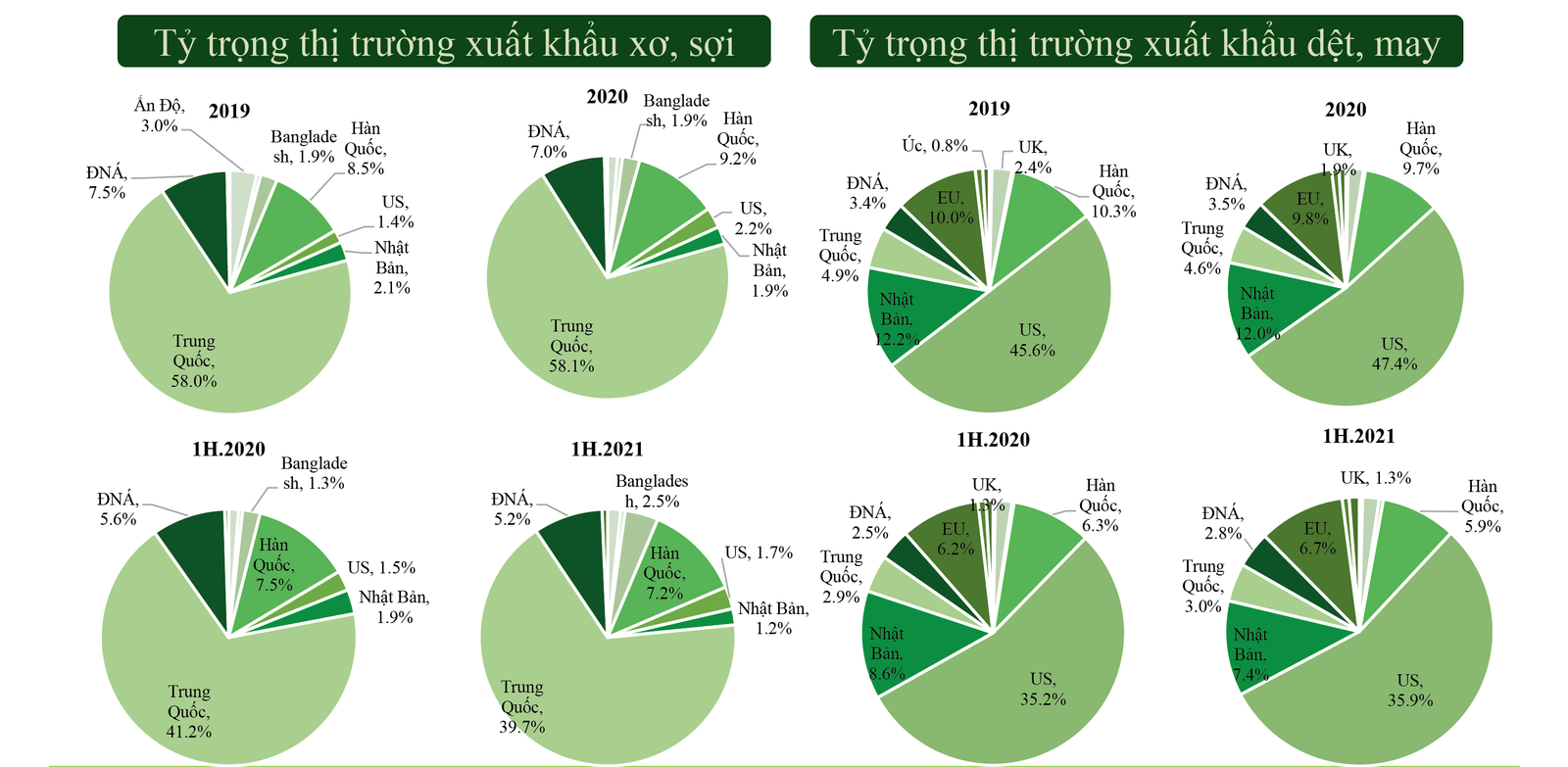

The report of Vietnam Foreign Trade Bank Securities Co., Ltd (VCBS) said that in 9 months, textile and garment exports to the US reached 11.6 billion USD, up 11% over the same period, accounting for 45 -50% of export value.

Since 2016, Vietnam has accounted for 15-19% of the apparel import market share in the US, just behind China. Notably, the export of fiber and yarn reached more than 25 million USD, sharply doubled over the same period while the garment products did not change much, the turnover reached 2.1 billion USD.

In the opposite direction, exports of textiles and garments to the CPTPP bloc decreased slightly, reaching nearly $3.4 billion because the value of exports to Japan, the largest customer in the bloc, decreased by 12%.

VCBS assesses that the textile and garment industry still has good growth despite many months of being affected by the COVID-19 epidemic.

Vietnam has become a supply destination chosen by many importers

Ourworldindata just announced that the rate of vaccine coverage in Vietnam is fast increasing, with 68 percent of the population immunized with at least one dose, the 19th highest in the world, after four months of accelerated immunization against COVID-19. Furthermore, corporations focus on “green” manufacturing procedures in factories, producing cotton and recycled yarns.

This will assist Vietnam in attracting additional orders from important partners interested in global supply chain sustainability, such as H&M, Uniqlo, Nike, and Adidas, among others.

Because of the aforementioned favorable conditions, as well as the robust recovery of the export market, the textile and garment industry’s revenue and profit expanded “at lightning speed.”

Despite more than 4 months of the heavy blockade in the southern provinces, the industry’s revenue accumulated over 9 months reached more than 48.5 trillion dongs, a modest rise over the same time. Profit before tax of listed textile and garment firms reached VND 3.3 trillion, up 1.5 times during the same period, surpassing the overall sector growth rate.

The ability of the company to balance the source of raw materials and the abrupt increase in the selling price of the yarn sector assists companies in increasing their profit margins.

According to VCBS, the US market is shifting the world’s textile and garment supply away from China, with Vietnam being one of the destinations for importers and retailers. As a result, the textile and garment export turnover in 2021 might reach 38.5 billion USD, and the potential for the textile and garment sector in 2022 is extremely broad.

Van Anh

FURTHER READING

Vietnam: The second largest garment exporter in the world