HIGHLIGHTS

- In an effort to reduce reliance on logistics outsources, Amazon has carried out 10 billion deliveries themselves by now with a worldwide fleet of 400,000 drivers, 40,000 pickups, 30,000 trucks, and a fleet of more than 70 aircrafts as well as an extensive distribution center system.

- Amazon’s formula for success: low prices, high-quality service and comprehensive e-commerce logistics solutions.

- With strong investments and a steady ecosystem, it is absolutely reasonable to believe that in the near future, Amazon will be a key-player in the logistics game for e-commerce.

FULL ARTICLE

Amazon: from E-commerce platform to 3PL logistics service provider or more?

Starting with e-commerce, Amazon can be considered a successful and pioneering model for e-commerce platforms around the world. Currently, Amazon is serving more than 300 million customers in more than 200 countries globally. The idea of penetrating into the logistics field to self-service their e-commerce system has been adopted since 2007 with the launch of the first Amazon Delivery Center. However, all the plans were not really implemented until 2013, when UPS did not work during the holidays despite huge demand. This made Amazon clearly realize the delivery market potential. Amazon Flex and Prime Air were launched in 2015 and 2016. Additionally, they managed to open over 71 delivery centers in 2017, adding another 51 the following year. Until now, after 7 years, Amazon has made 10 billion deliveries with a team of 400,000 drivers worldwide, 40,000 pickup trucks, 30,000 trucks and a fleet of more than 70 aircraft. The biggest investment which cost this giant $1.5 billion is the Amazon Air hub that opened in Kentucky in August.

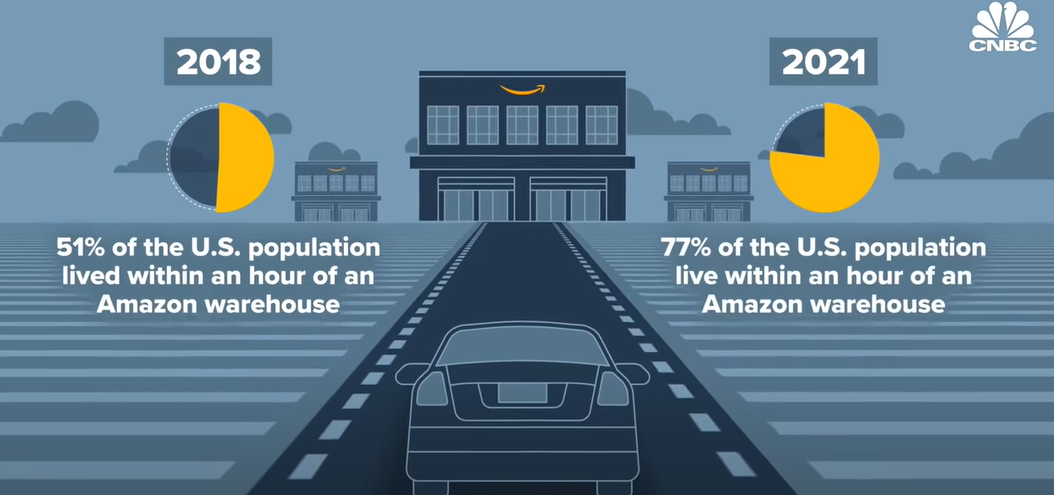

With efforts to set up its own logistics system, Amazon has shortened the distance and delivery time to its customers, creating a competitive advantage that is difficult for competitors to overcome.

According to Amazon’s first-quarter 2021 business report, investment costs are 80% higher than that of the previous year in order to fulfill its goal of increasing its internal logistics network capacity by 50% YoY (year-over-year). Currently, according to SJ Consulting Group, Amazon currently ships 72% of its own goods, up from 46.6% in 2019.

In order to take advantage of its available resources to maximize profits, Amazon not only serves their own e-commerce platform, but also provides shipping services to external customers. In the UK, Amazon is launching a “Logistics as a service” program – a business model that is expected to launch in the US this year or next year.

According to an investigation, Amazon has begun to deliver goods on its planes for the US Postal Service, however, according to some analysts, Amazon’s business service will not be similar to traditional delivery services provided by FedEx and UPS.

Is a traditional recipe the secret to Amazon’s success?

Amazon doesn’t just offer traditional delivery: “deliver any package you want, to any address”. Amazon selects and optimizes the route, operates, and arranges the parcel sizes it wants to deliver. They will only deliver packages to the most cost-effective locations — large, crowded areas — where they can deliver more packages faster. Furthermore, they plan to use neighborhood delivery locations where people in the community can pick up their packages.

Most of Amazon’s customers deliver goods by LTL (Less than Truckload) method, so optimized algorithms are applied by to make the most of truck space, and Amazon can use the remaining space of the truck for loading more goods, therefore, their customers will receive surprisingly cheap shipping rates, while Amazon itself makes quite a bit of profit.

According to Highland Laboratories – a vitamin and supplement company in Oregon (USA) that has just used the Amazon Freight program, Amazon charges up to $1,700 less than FedEx or UPS for some shipping routes from Oregon to Southern California.

However, cheap price is not everything, the service quality and Amazon’s willingness to serve drive customer satisfaction and decision to company with Amazon. Compared to UPS or Fedex, Amazon is more willing to serve suburban, sparsely populated and seemingly “not very potential” customers with the same quality of service: punctuality and dedication to satisfaction.

An end-to-end integration service is undeniable. In addition to shipping, Amazon offers customers a Fulfilled By Amazon (FBA) service for orders not fulfilled on Amazon.com. This also partly explains why orders placed from eBay, Walmart and others are delivered to customers in Amazon packaging.

Amazon is expanding its pie slice when it comes to certain customers whose orders from all channels are shipped 100% by Amazon. Plugable Technologies – a company that sells consumer electronics is a good example. Although their product is ordered from eBay – Amazon’s direct competitor in the field of e-commerce, the product actually comes from an Amazon warehouse and very often is delivered by the Amazon delivery service.

Is this a reckless game for Amazon?

The answer is certainly not. This is not the first time Amazon has stepped into a new field. In the past, Amazon has exploited its huge resources and data many times to enter the online movie field with Prime Video – becoming a rival to Netflix or Disney Plus; or the field of providing integrated digital solutions with Amazon Web Services with a range of services to help businesses perform digital transformation. Moreover, with the available resources and Amazon ecosystem being so powerful, people have the right to believe that in the near future, Amazon can become one of the big names in the field of door-to-door delivery beside UPS, FedEx or DHL.

Nhat Huyen

FURTHER READING

Amazon partnered with BigCommerce to increase pressure for companies 3PLs