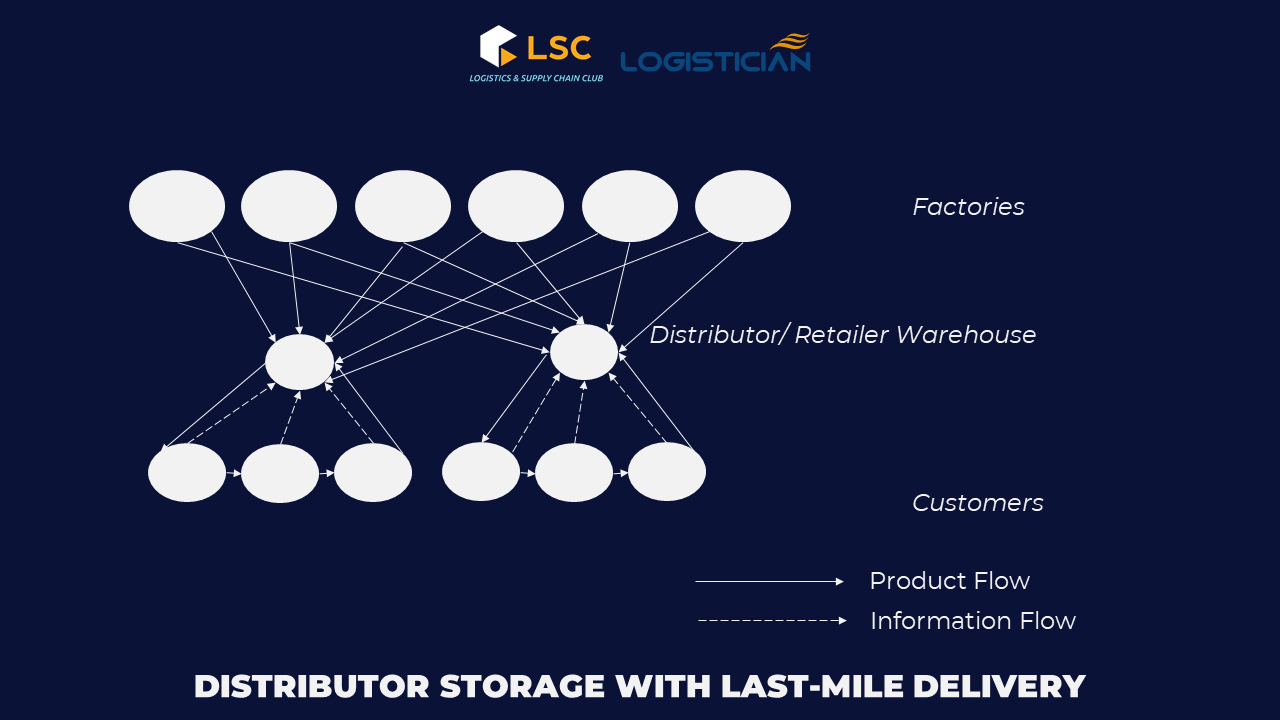

Distributor Storage with Last-Mile Delivery

Last-mile delivery refers to a distributor/retailer delivering products to a customer’s home instead of using a package carrier.

In Vietnam, Tiki E-commerce Company (Tiki Corporation) has been successfully applying the above method. With the criterion of taking user experience as the top priority, in 2017, Tiki.vn launched the TikiNow fast delivery service “Buy Tiki – Receive in 2 hours”.

Accordingly, all products with the 2-hour logo ordered through Tiki.vn can be delivered to consumers within 2 hours. Not only that, to ensure fast delivery, Tiki also invests in a large-scale and extensive warehouse system throughout major cities across the country. Besides, Tiki now has a team to specialize in its delivery operations.

Unlike bale delivery, last-mile delivery requires the distributor’s warehouse to be much closer to the customer. In this model, the distributor needs to have more stock than in the delivery model through another carrier.

Accordingly, the last mile store and delivery distributor model requires higher inventory levels than other models (except the retail store model) because it has a lower aggregate level. From an inventory perspective, this model will be suitable for items that require quick shipping.

In this model, distributors have to spend a large amount of money on last-mile delivery, especially when delivering to individual customers. Last-mile delivery costs will be less expensive in large, crowded cities. An example of this is the home delivery of large water bottles and bags of rice, which has been very successful in China, where high population density has resulted in a large reduction in delivery costs.

Besides, for this model, the cost of infrastructure investment and order processing is also very high. Order information requirements are similar to the base model but require more clarity on delivery schedules and order tracking to promptly handle last-mile delivery issues.

This model has fast order response times but product variety is often lower than using a carrier for parcel delivery. The customer experience is very good, especially for bulky size products. Out of all the models above, last-mile recall is the best because the retailer can recall the product from the customer immediately after delivery.

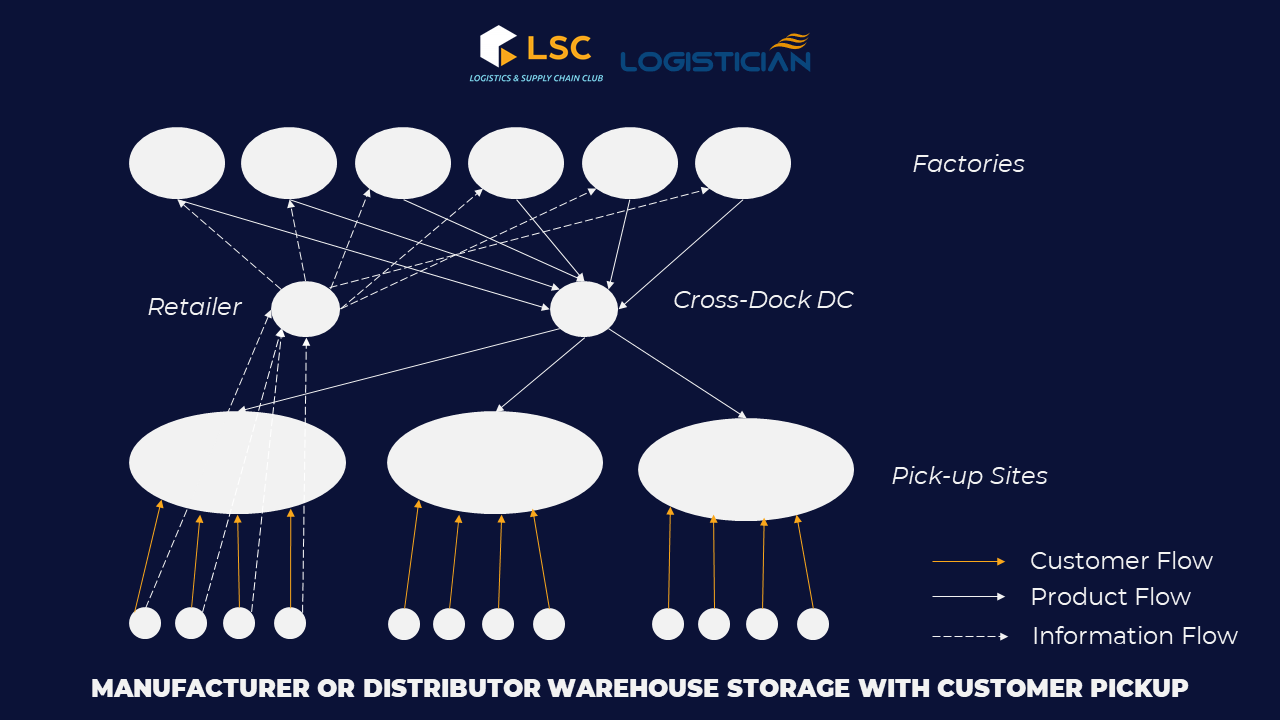

Manufacturer or Distributor Storage with Customer Pickup

Under this model, inventory is stored at a manufacturer or distributor, customers place an order online or by phone, and then they go to pick-up points set up by the manufacturer. or designated distributor to receive the goods. Orders will be shipped from storage to collection points as needed.

In 2007, Wal-Mart launched a “Site to Store” service that allowed customers to order thousands of products online at Walmart.com and get free shipping to a local Wal-Mart store. Items will arrive in stores 7 to 10 days after the order is processed, and customers will then receive a delivery notification email when their item has arrived at their designated destination.

Storage costs in this model can be kept low for the manufacturer/distributor. Shipping costs are also lower than with any other distribution model by using a single-piece carrier to integrate the delivery of orders to the same pickup location. However, the cost of infrastructure investment is quite high if new delivery points have to be built. Therefore, this model is most effective if it takes advantage of the existing grocery/convenience store network as a collection point, thereby helping the supply chain reduce investment costs and increase the economy of the network. now available.

Order processing costs at the manufacturer/warehouse are similar to other models but at the point of delivery will be higher. This is also the biggest barrier to the success of this model. At the same time, the model requires a good information infrastructure and close coordination between retailers, stocking locations, and receiving locations to provide order visibility until the customer receives the product. Products.

In addition, this model will also have some losses in terms of customer experience, because, unlike other models, customers have to come to the place to pick up the goods themselves. On the other hand, customers who do not want to pay online can pay with cash in this method.

In this model, order visibility is extremely important for customer picking. The customer must be notified when the order has arrived, and the order must be easily identified when the customer picks it up. Such a system is difficult to implement because it requires the integration of several stages in the supply chain. Returns can be handled at the pick-up location, making it easier for customers.

Metro Cash & Carry is probably a memorable name in Vietnam when it pioneered the application of this method, creating its path to become special in the retail and distribution market. In 2002, Metro entered the Vietnamese market as the largest wholesaler. Possessing prime locations at the gateways of big cities, or suburban areas where the location is spacious and the traffic density is not too high, Metro provides customers with the solution of “going to a place where they can buy and get more goods”.

Taking advantage of the scale when the distribution area is built large combined with the display of a variety of products, Metro attracts buyers because the prices of all items are extremely competitive compared to other retailers.

Retail Storage with Customer Pickup

This model is the most traditional in the supply chain, with inventory stored locally at retail stores. This seems to be the most popular and familiar delivery method among consumers. Consumers can order at a retail store, also order online or by phone, and then pick up the goods at the retail outlet. It is this that increases cost because of the lack of integration in freight forwarding. However, with FMCG items, margins can still increase even when stockpiling in place is required.

Shipping costs in this model are much lower than in other models because a low-cost mode of transportation can be used to replenish products to the retail store. Infrastructure investment costs are high because many local stores are required. For orders that customers come to buy at the store, only a minimal information infrastructure is needed, but for online orders, a good information infrastructure is needed to provide visibility of orders until when the customer receives the product.

In Vietnam, there are some supermarket chains such as Coopmart, AEON, Lotte Mart, Vinmart, or convenience store chains such as Family mart, Circle K, B’smart, etc.

Response times are good thanks to the inventory in place, but this, in turn, increases the cost of securing the stock. The variety of products stocked in place is lower compared to other models. The possibility of recall is quite good using this model as recalled products can be handled at the point of receipt. This model is considered best suited for FMCG or when customers require a quick response.

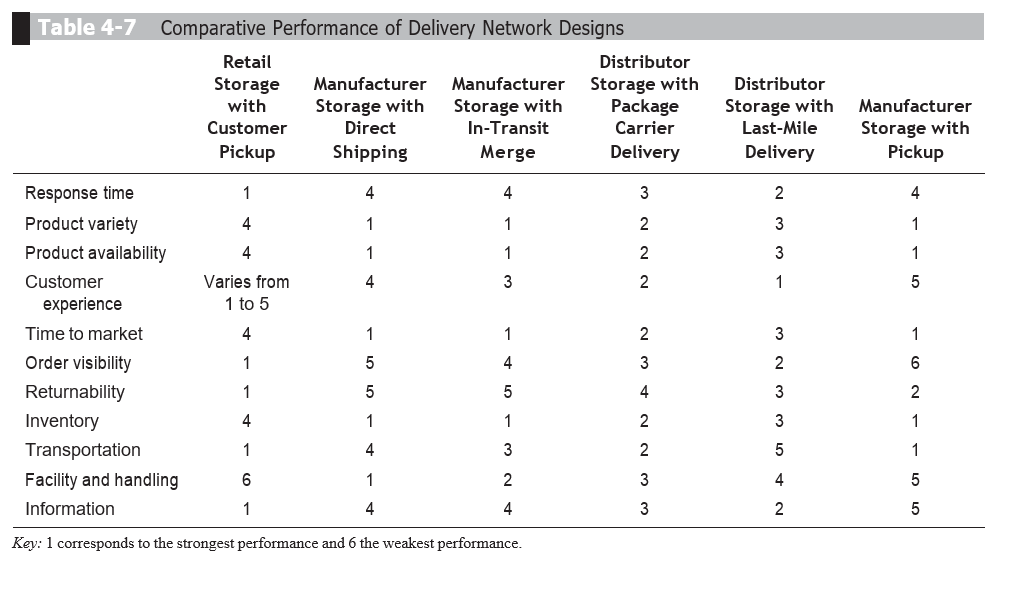

To choose the right model, businesses need to consider the product’s characteristics as well as the model’s requirements. Each model will have different strengths and weaknesses.

The following is a ranking of the performance level of each model.

Phan Quyen