HIGHLIGHTS

- Under recent occurrences, chip makers expect the supply of raw materials to be even tighter this year.

- However, those worries might not be realised, at least not in the near term because the industry has gradually reset how it operates.

- Risks on prices are still likely to occur but only have a tiny effect on the chip industry’s cost structure.

FULL ARTICLE

More difficulties in sourcing raw materials

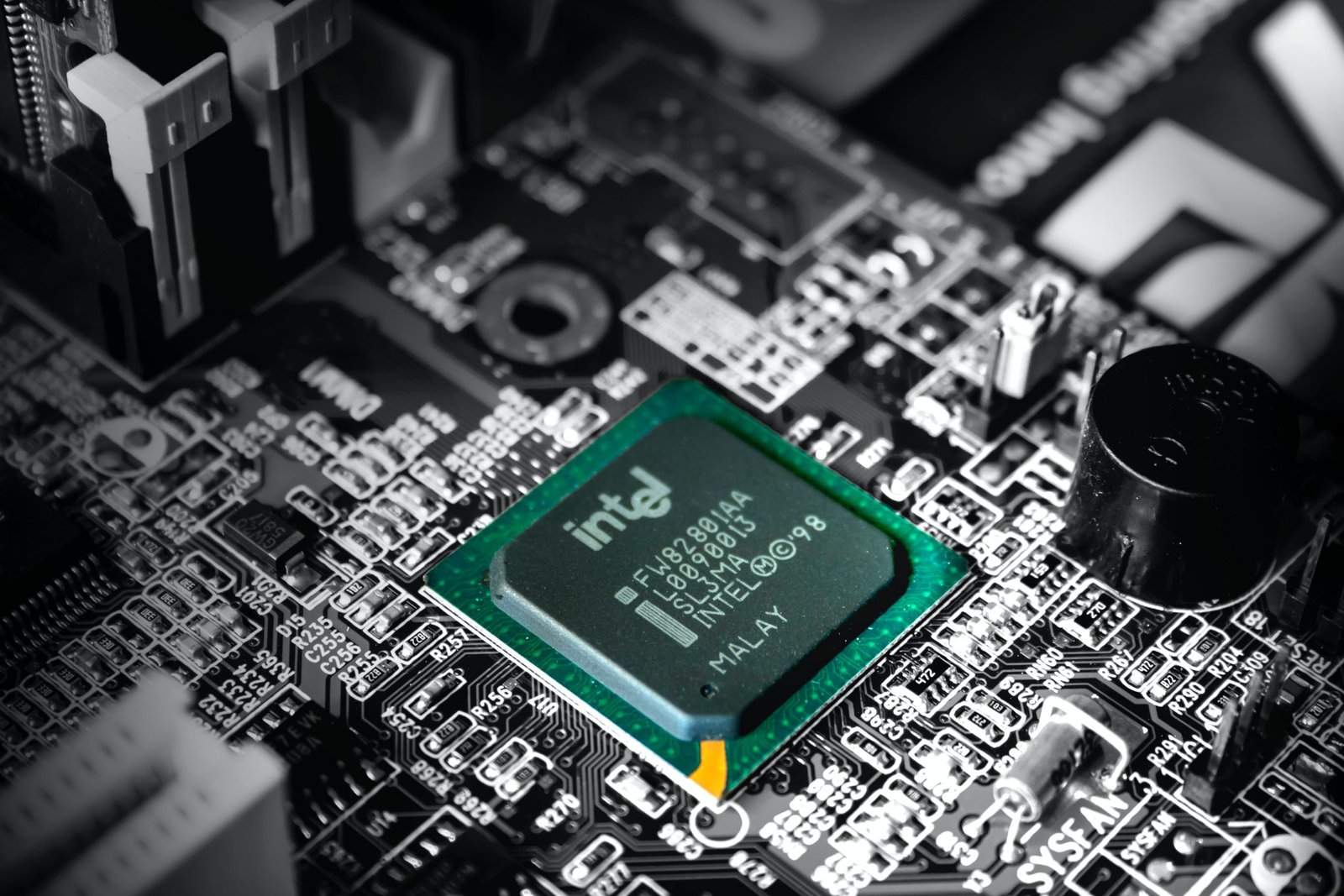

Most of the important raw materials in the production of electronic chips are concentrated in Russia and Ukraine. These countries are major sources of neon and other chemicals needed for the chip industry.

The chip industry estimates that about a quarter to half of the world’s semiconductor neon comes from Russia and Ukraine, while about a third of the world’s palladium comes from Russia. The risk of shortages of these materials has raised concerns that the chip and semiconductor industries, which have been struggling to meet hot market demand, might have been in a lot more pain.

According to Reuters, in early February, the White House warned chip manufacturers to diversify their supply chains in case that Russia retaliates against US export restrictions by blocking access to chip materials. Those companies expect the supply of raw materials to be even tighter this year. Russian attacks could also increase lead times and shipping costs, further adding strain to the already disrupted global supply chain.

Opportunity from danger

However, those worries might not be realised, at least not in the near term. The reason is the industry has gradually reset how it operates after being whipsawed by pandemic-era demand and repeated shocks. Those have included the Renesas Electronics chip factory fire, the unusually cold Texas, drought in Taiwan and the coronavirus pandemic. Chip manufacturing companies have soon had plans to strengthen their supply chains, diversify supplies and stockpile essential materials in case global logistics continues to be disrupted.

In particular, for chip companies, Russia’s annexation of Crimea in 2014 was an early lesson in dealing with political instability in the material supply region. Taiwan Semiconductor Manufacturing Company, TSM, the world’s largest contract chip maker, ensured it was preparing an alternative supply of neon as soon as Russia began massing forces along the Ukrainian border. Infineon Technologies, a large German chip maker that supplies the auto industry, also announced that it has increased its inventories of potentially affected raw materials and noble gases.

Risks on input prices are still likely to occur, prices of raw materials may skyrocket. However, even with a 10-fold increase in prices, noble gases such as neon represent only a tiny fraction of the industry’s cost structure. The semiconductor industry is estimated to be worth around $100 million a year, compared with global revenues for chips of above $500 billion.

Mai Phạm

New supply solution to replace China