HIGHLIGHTS

- Iron prices have now fallen from a July peak of $300 a tonne to just $228 on Thursday night as China pulls back its steel production.

- The falling iron ore prices will probably continue for at least six months and expose Australia to the costs of the trade war.

- In June, when prices peaked, Australia sold about $1 billion in iron ore to China.

FULL ARTICLE

The move ended the dependence of China’s iron ore

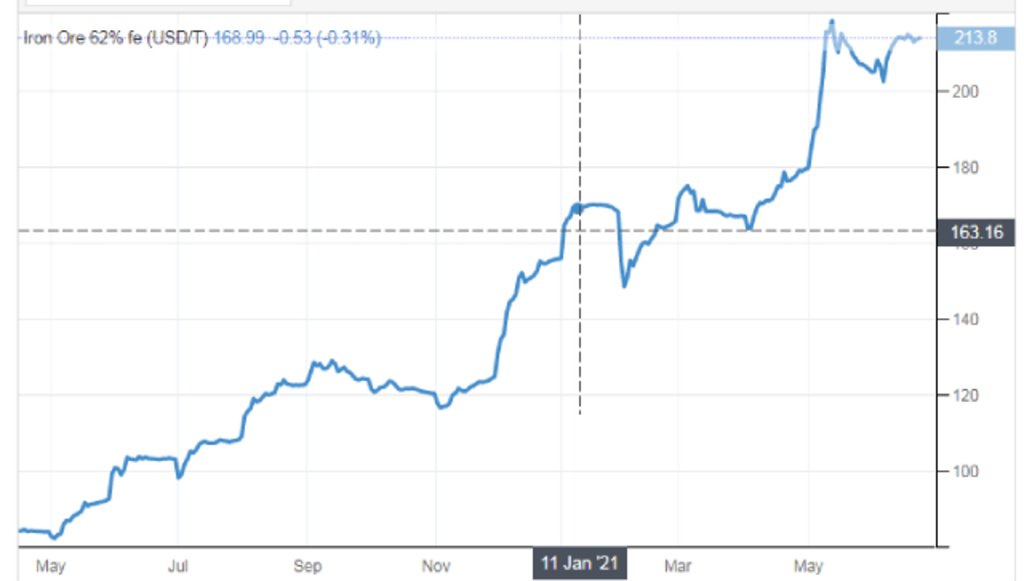

Iron ore has remained the one bright spot in Australia’s relationship with China over the past year, with skyrocketing prices driving billions of dollars into the economy and offsetting restrictions on other exports. But iron prices have now fallen from a July peak of $300 a tonne to just $228 on Thursday night as China pulls back its steel production.

The move is part of a bigger effort from China to end its reliance on our iron ore and punish Australia for failing to toe the Beijing line on human rights.

China’s restrictions on other exports – including coal, copper, beef, wine, cotton, barley, wood and lobsters – cost Australia $6.6 billion from June 2020 to February 2021, according to University of Adelaide data. That cost could blowout to $23 billion if the restrictions grind exports to zero over a 12 month period.

The impact will be felt most in the value of the Australian dollar and tax revenues reaped by governments, economist Saul Eslake said. Mr Eslake added that the falling iron ore prices will probably continue for at least six months and expose Australia to the costs of the trade war.

Australian exports to China still above average

The annualised rate of restricted exports to China has fallen from $25 billion in 2019 to $5.5 billion since the trade war began. That’s more, in total, than the value of Australia’s iron ore trade to China.

When iron prices were lower Australia was selling many other goods into China that had ground to a halt under the current trade war. The only things Australia is selling more to China today than a year ago are iron, gold, wool and some base metals.

Because iron is the vast majority of exports to China, falls in price have an outsized impact on the Australian economy. In June, when prices peaked, Australia sold about $1 billion in iron ore to China, according to Australian Bureau of Statistics (ABS) data. The Australian government has been raking in billions in tax revenue in the latest iron ore price boom, money that helped fund the COVID recovery.

To mitigate the impact of China’s actions, Australian exporters are looking to markets outside of China. But new business partners are not willing to pay high prices for goods exported from Australia. This indicates that the Australian economy will be affected in the medium term, even if manufacturers find new supply channels.

Phan Quyen

FURTHER READING