Who is Dollar General?

Dollar General, an American chain of grocery stores headquartered in Tennessee, was founded in 1938, run as a family-owned business with the name J.L. In 1955, the company was renamed Dollar General.

This company pursues against-the-flow strategy, which perhaps brings it a lot of success. In 2020, Dollar General was ranked 112 in Fortune 500 and became one of the largest retail chains in the US. The following part will figure out the causes behind these achievements.

The biggest differentiator: Location, location, location

During the period of retail renaissance or even in the Covid-19, Dollar General still thrived with truly innovative moves. It is widely believed that the secret to make Dollar General prosper is its low cost strategy. According to Business Insider, its prices are generally 20%-40% lower than average, attracting cost-conscious consumers.

It is undeniable that this strategy is one element that contributed to the company’s success (and will be mentioned in the next part). But, above all, the cause that seems to be most different which takes a large portion in Dollar General achievements is store location.

The key is location strategy, which makes Dollar General remain top-of-mind and insert itself into consumers’ shopping habits. Dollar General, against all trends, has opened stores and expanded rapidly away from population centers.

“Dollar General go where Walmart aren’t”

Walmart operates fewer but bigger stores, but makes a lot of difficulty for citizens who are in rural areas to access. Meanwhile, with the strategy of “Dollar General go where Walmart aren’t”, its outlets are placed in smaller, underserved communities. Dollar General stores are generally found on remote roads in rural and suburban America. It has the appearance of being in the middle of nowhere, but this is meticulously planned, very well thought through strategy.

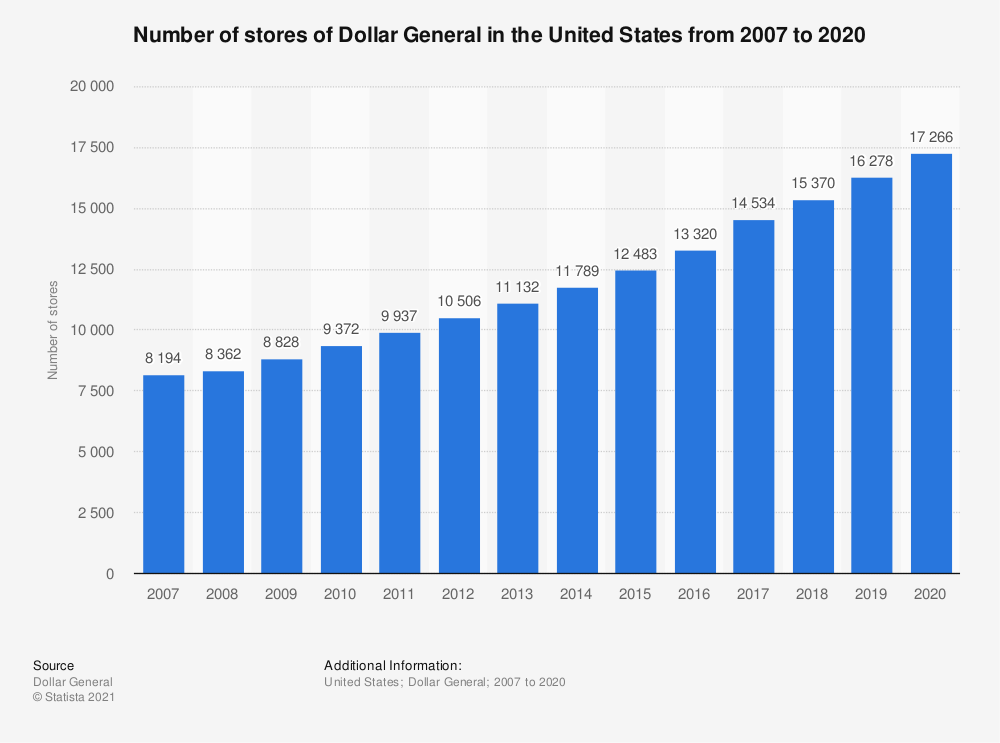

The company has formulas for identifying the locations to open stores. Often the Dollar General was found to be down the road miles away from the nearest town and Walmart. In fact, there are currently more than 17,000 stores across 46 U.S states, which surpasses even the number of McDonald’s.

Seventy-five percent of Americans live within five minutes from Dollar General stores, according to Global Data Retail, and these locations are strategically placed to allow shoppers to choose to patronize them over other discount or big box retailers. Compare that to 37 percent of Americans who live within that distance from a Walmart. Furthermore, more than half of Dollar General stores are located less than a ten minute drive from a Walmart, according to research from UBS analysts.

Dollar General is located in areas with limited shopping options. Actually, three quarters of Dollar General stores serve communities of 20.000 people or less. Therefore, General Dollar looks for a place that may be called a food desert, where there are not a grocery store or a big box store. Hence, Dollar General is believed to be needed, first and foremost.

Cut cost everywhere if possible

Not only the unique location strategy, Dollar General conducts an effective cost controlling strategy, which minimizes its total operation cost to offer consumers at a competitive price.

Let’s take location strategy into account again! Dollar General outlets are situated in suburban areas, where the real estate cost is fairly low. Moreover, Dollar General tends to lease their properties rather than buy them. Their stores are pretty small, on average 7,400 square feet (compared to 178,000 square feet of Walmart) with the design as simple as possible. Therefore, it’s truly a no-frills shopping experience, the average shopping trip here lasts no more than 10 minutes.

With no-frill stores, Dollar General only staffed by a minimum level. According to UBS, its employee wages are lower than competitors. In addition, often part-time staff the company keeps the labour cost down.

Additionally, compared to grocery stores, the company has less perishable items, which have a shorter shelf life and bring in lower margins. Critics say Dollar General strategy does harm local communities by not providing healthy food. But from a business perspective it helps to keep the margin strong.

These are also reasons why company goods are always kept at low level, even in the pandemic period when everything keeps rising from the pallets to the shipping cost. Dollar General says that it hasn’t and doesn’t plan to drive up prices, while other retailers are continuously raising costs to offset the trend. The unique strategy perhaps helps the company to survive and develop even in the hard periods of pandemic.

Quitely thriving in the face of behemoths

Nothing against the Dollar General stores, because they do provide a service for some areas that don’t have certain things. By that way, Dollar General is day by day quitely thriving in the face of behemoths like Amazon and Walmart. Dollar General’s approach seeks its unique niche and business strategy, which aligns with the most important sales lessons: know your customer.

With all continuously innovative steps, Dollar General has gained a lot of achievements. Or even in the black swan times of Covid-19, Dollar General did not hold back brick-and-mortar expansion in fiscal 2020, as the dollar store chain tallied growth of more than 20% in net sales and over 15% in same-store sales for the year.

In fact Dollar General gained a lot of benefits from pandemic-related consumer behaviour trends. Before Covid, this retailer was already taking advantage of economic recessions, a new fondness of consumers for frugality (and discounters) to amass impressive revenue and expansion over the past decade. Now, post – Covid 19, the company is planning to leverage momentum from the pandemic to keep aggressively opening stores, become even more of a grocery store than a dollar store, ramp up digital capabilities to help drive all of that new growth.

Huyen Tran

Read more: The risk of inflation due to global supply chain disruption