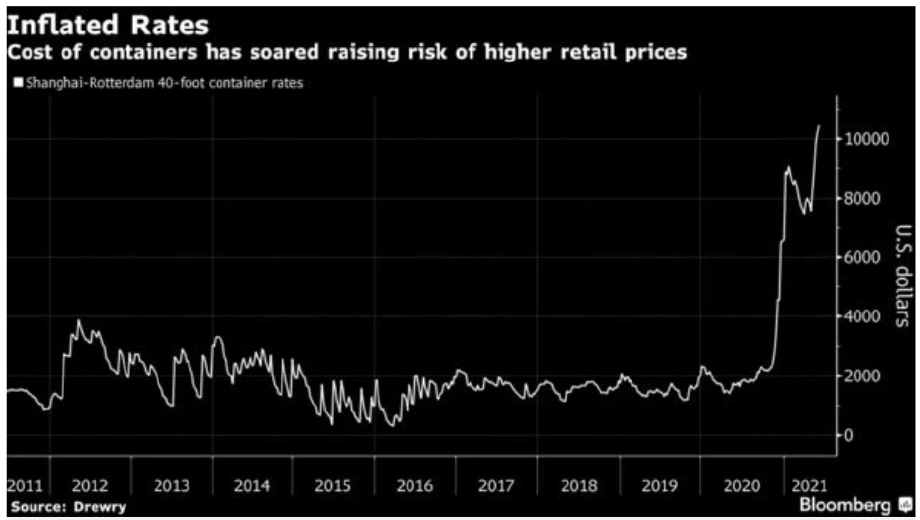

Container shipping cost increases sharply

According to data from Drewry Shipping-the leading research and consult in maritime industry organization, the cost to ship a 40-foot container by sea from Shanghai to Rotterdam has now hit a record high of $10,522 – up 547% from the recent five-year average. Specifically, this price increased 3.1% compared to 1 week ago and increased 485% compared to 1 year ago. The fare composite index on 8 major routes increased 2% from the previous week, to $6,257 and up 293% from a year ago. All indexes are at their highest levels since 2011. Since 80% of the world’s goods are shipped by sea, rising freight rates threaten to drive up prices for everything from children’s toys to furniture, auto parts to things as small as coffee, sugar. This increases the fear of inflation.

“Over 40 years in toy retail, I’ve never seen prices so intensive” said Gary Grant, founder and chairman of the UK toy chain The Entertainer. He had to stop importing big teddy bears from China because if so, he must double the retail price to cover the shipping costs.

Significant impact on manufacturers and retailers

Currently, the market is facing a series of constraints at the same time: surging demand, container shortages, port congestion, and the lack of ships and workers, etc. As a result, almost all sectors suffer from a lot of pressure. Recently, the Covid-19 broke out in some Asian export hubs such as in some Chinese ports, making the situation much worse.

Retailers are among three choices: suspend imports, raise prices, or pay forward by themselves then charge consumers. However, all of these would lead to an increase in prices. “In the present, part of the cost burden has been transferred to consumers”, said Jordi Espin, an expert of the Council of Ocean Transporters in Europe, which represents around 100,000 retailers, wholesalers and manufacturers.

Companies that produce bulky but low-value items such as toys and furniture are more affected. “For some manufacturers of low-cost furniture, freight now accounts for 62 percent of total retail prices”, said Alan Murphy, CEO of Copenhagen-based consulting firm Sea-Intelligence.

Companies are still doing their best to get through this tough period. Some stopped exporting to certain markets while some tried to source goods or materials from closer suppliers to cut costs. The longer the situation lasts, the more companies will have to find solutions to cope with such as restructure or shorten the supply chain.

Van Anh