1. AMS (Automated Manifest System)

After the terrorist attacks of September 11, 2001, the US increasingly focused on tightening safety measures in transporting goods. For that reason, the Automated Manifest System (AMS) became an essential task for exporters when transporting goods to the United States.

AMS, established by the US Customs and Border Protection CBP, is a declaration system that controls goods by all modes of import and export within the United States.

To avoid unfortunate situations, there are a few points that exporters need to pay attention to in the AMS declaration, including:

- Content:

Cargo information: Consignment’s bill of lading number, cargo type, name and address of shipper and consignee, the weight of cargo, etc.

Container information: container number, seal number, etc.

The mother ship information: Route (including place of receipt, port of loading, port of transit, port of discharge, final destination); Time (at departure, arrival at the port of transit, ship unloading, ship to the final destination, etc.)

- AMS declarer: Includes parties directly involved in the AMS declaration process, such as shipping lines or NVOCCs, who declare on behalf of the exporter. AMS is declared by carriers through their websites or authorized intermediaries connected to the US Navy network. The carrier needs to be given a unique username and password to declare.

- Fees: As a rule, the AMS fee, which is not calculated according to the quantity or volume of the goods, usually ranges from 30 to 40 USD per shipment.

- Time: Generally, AMS submission must be made at least 48 hours before departure of the mother vessel from the final port of transit. The declarant is free to amend all information before the above deadline. Late AMS declarations will result in fines of up to USD 5000 per shipment from US customs. US customs will notify this penalty after a few months as the goods are officially on board, even a year. The fine will be accrued for all shipments that the shipping company declared late during that time. In case the exporter is not paid the fine, they will be blacklisted and their goods will not be accepted into the US market.

2. ISF (Importer Security Filing)

Besides AMS, from January 2010, all goods entering the United States are required to complete Importer Security Filing (ISF), which is required by US Customs and Border Protection.

Importers must provide information similar to AMS and add other information such as manufacturer, importer of record number, commodity HTSUS number, consolidator.

ISF is also known as 10+2 because this is the amount of information to be declared, which includes:

On the side of the importer/supplier:

- Seller’s name and address

- Buyer’s name and address

- Importer of record number / foreign trade zone applicant identification number

- Consignee number

- Manufacturer or supplier name and address

- Ship-to name and address

- Country of origin

- HS code

- Container stuffing location

- Consolidator’s name and address

On the side of the service provider

- Vessel stow plan

- Container status messages

Similar to AMS, the importer must complete the ISF 48 hours before the cargo ship at the port of transit departs for the United States. Because AMS and ISF are similar in time, these two procedures are often performed simultaneously. Shipping lines, airlines or forwarders will usually carry out this procedure for the importer.

Penalty fees:

If the ISF records are incorrect, CBP may refuse to issue a discharge permit or take the cargo away. If the cargo is unloaded without CBP’s permission, they may seize the cargo and the command “Do not load” will be applied to the goods.

US Customs has divided different penalties for errors in ISF declaration as follows:

- Failure to file ISF – $5,000 / shipment

- Late filing of ISF – $5,000 / shipment

- Incomplete filing of ISF – $5,000 / shipment

- Failure to withdraw ISF – $5,000 / shipment

- Failure to match ISF filing to Bill of Lading – $5,000 / shipment

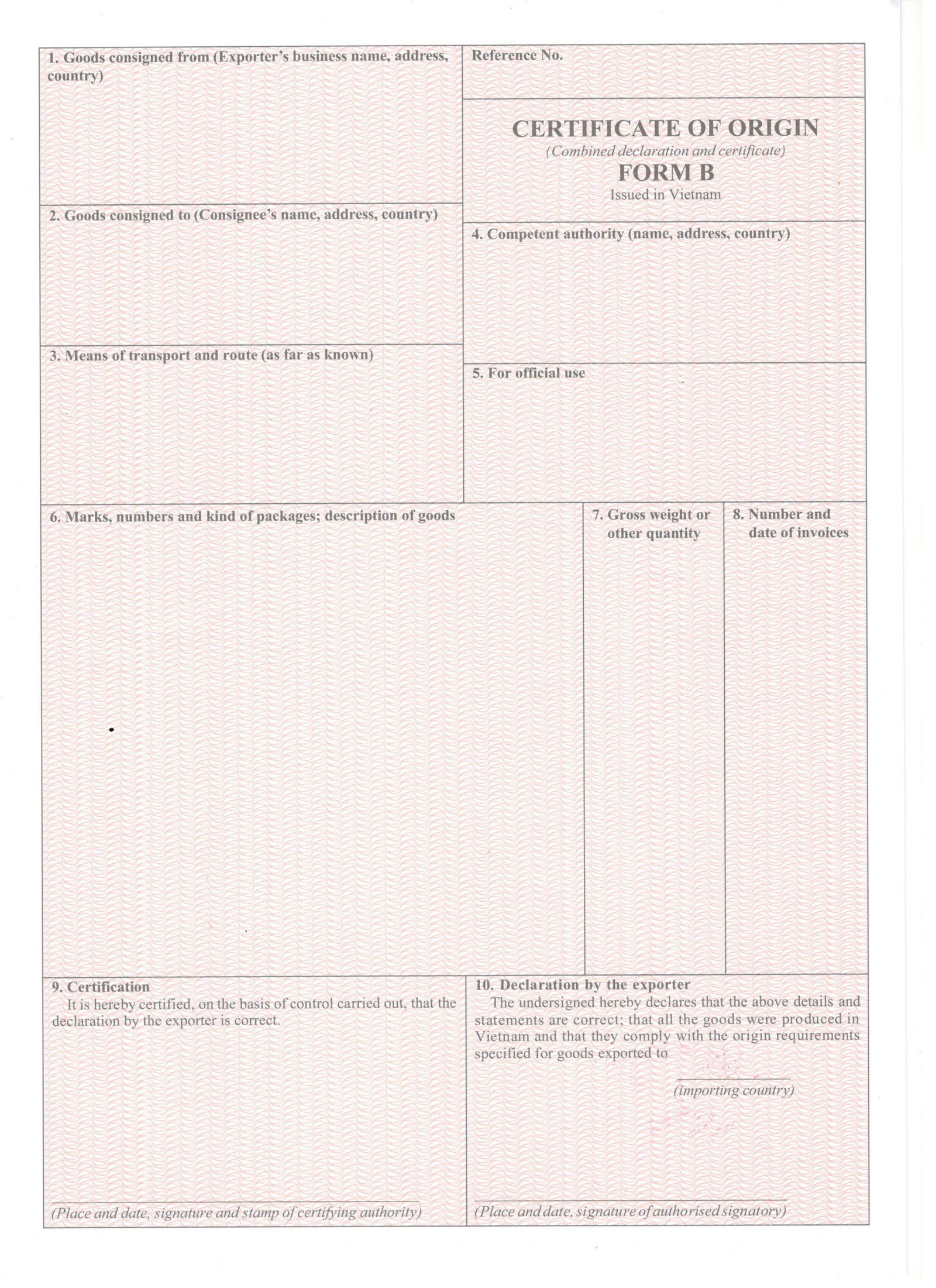

3. C/O form B

To prove the origin of goods, enterprises exporting goods to the US need to declare C/O form B, one of the popular C/O forms issued by the Vietnam Chamber of Commerce and Industry VCCI and applied to exports from other countries.

C/O form B is issued for goods originating in Vietnam and exported to other countries in the world in the following cases:

- The importing country does not have a Generalized System of Preferences (GSP).

- Importing countries have a GSP regime, but Vietnam does not enjoy preferential treatment.

- The importing country has the GSP preferential regime, but the exported goods do not meet the standards set by this regime.

If you want to apply for a CO form B at VCCI, you need to prepare a complete set of documents, including:

- CO application form

- Printed and stamped CO form B

- A cleared export customs declaration (if the goods use imported materials, the import declaration must be attached)

- Bill of lading

- Commercial invoice

- Packing list

- Production process

- Documents proving the origin of raw materials (list according to the form of Circular 05/2018/TT-BCT).

4. Bond Application

A Bond Application is an insurance policy issued by an underwriting company to insure the importer’s obligation to pay customs duties and taxes.

Currently, there are two types of Bond Applications as Single Bond and Continuous Bond. The following table is the difference between them:

| Single Bond | Continuous Bond |

| Single Bond is the premium that will be purchased for orders imported into the US only once or several times. | Continuous Bond is the premium purchased annually and will be applied to all shipments imported to the importer during that year. |

| The fee will be charged in units of $1000 of the value of the imported goods. | There will be a minimum payment of $50,000 for one purchase. |

| Single Bonds will benefit with only small orders being imported into the US. | Continuous Bond is often used in the case of frequent imports. |

5. POA (Power of Attorney)

A power of attorney (POA) is a legal document given to a person, agent, or attorney. Accordingly, the Authorized Party can act on behalf of the Mandate. POA is often used by inexperienced exporters.

Two types of power of attorney are general powers and limited powers.

- General powers: the Authorized Party can act on behalf of the Mandate in any matter, as permitted by the laws of that country. Agents under such an arrangement may be authorized to handle bank accounts, sign checks, sell assets, manage assets, and pay taxes on principal.

- Limited powers: Authorization that allows the portfolio manager to perform certain functions on behalf of the account holder. Overall, it allows the manager to execute an agreed-upon investment strategy and do regular related work without contacting the account holder. Limited powers may be in effect for a specific period. For example, if the principal is out of the country for two years, the authorization may only be valid for that period.

6. X-ray

After the attacks of September 11, 2001, US Congress became concerned that terrorists could use containers to smuggle weapons of mass destruction, especially nuclear weapons, into the country. Customs and Border Protection (CBP), an agency of the Department of Homeland Security (DHS), scans every container entering the United States by sea or land for radiation. In 2007, the US Congress required DHS to use both radiation detectors and imaging systems to scan and photograph all containers at sea before they are loaded onto a ship bound for the United States. This container screening takes place at the transit or destination port in the United States.

At the United States’ destination port, scanning containers take a lot of time. In the case of goods being held for container scanning (X-ray), it is up to INCOTERMS that the US exporter or importer pays this cost.

To meet the scanning of a lot of containers, the US has offered an additional scan of containers right at the port of transit. CBP or its foreign partners will install a container scanner at another country’s port where the containers are loaded onto ships bound for the United States. The average cost of container scanning will range from $150 to $220 for each container. Vietnam also has several ports supported by the US Government to install this system, such as Cat Lai port (2019), three ports under the management of Ba Ria – Vung Tau Customs Department (Tan Port Port – Cai Mep (TCCT), Tan Cang – Cai Mep International Container Terminal (TCIT) and SP-PSA International Port).

Manh Nguyen

USA: 24/7 port operations plan reduces pressure on the supply chain