HIGHLIGHTS

- China once again halted global logistics by “Zero Covid”

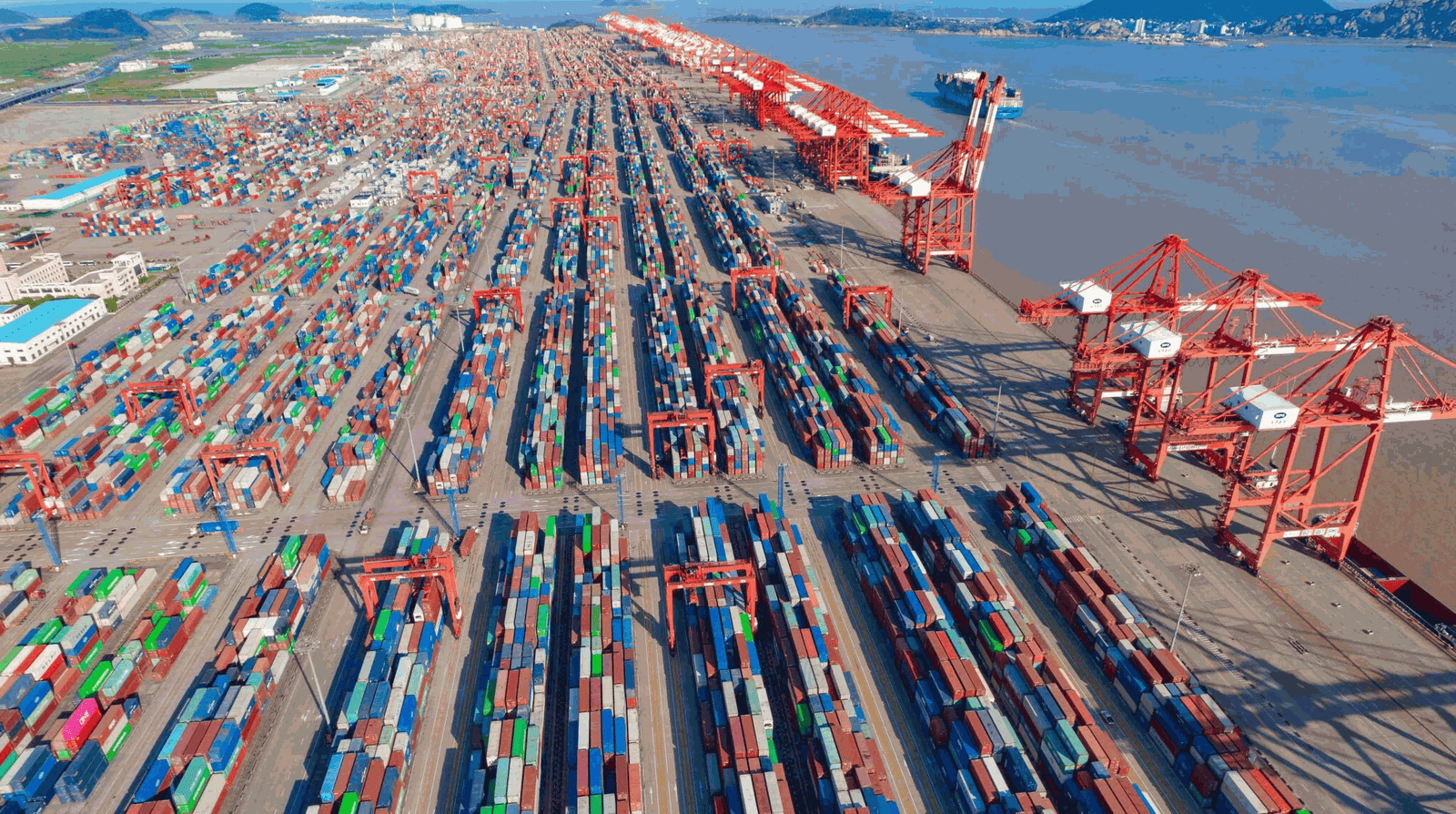

- Congestion of goods at many major ports causes shortages of production materials and affects the global supply chain

- This situation is predicted to continue and worsen in the coming months

FULL ARTICLE

Waiting for goods to “long neck”

Although China has begun to ease the blockade and restrictions in a few places like Shanghai, the effects of “Zero Covid” still cause global logistics to encounter some obstacles. This could put further pressure on global supply chains, already rattled by the Russia-Ukraine conflict, and cause inflation to continue to soar around the world.

According to data from Project 44, which tracks the global logistics market, shipping delays between China and major US and European ports have quadrupled since the end of March. By the end of April, freight trains from China to Seattle are mostly four days behind schedule.

In addition, drivers also face many difficulties when delivering and receiving containers at Shanghai port because of blockade orders, travel restrictions and Covid testing requirements every day. Josh Brazil, Logistics Data Manager at Project 44, said: “The blockade orders, travel restrictions due to “Zero Covid” in Shanghai make it difficult for trucks to deliver goods, prolonging delivery time, hindering import and export and potential risk of goods accumulation”. This has also been warned by Maersk in an earlier consultation session.

Shanghai Domino Effect

Although during the blockade, Shanghai port is still open and operating normally, but the data shows that the backlog of cargo ships and containers from different shipping lines is increasing. Not only Shanghai, but also neighboring cities like Beijing are in a similar situation. Josh Brazil predicted that this situation will continue in the coming months even when the blockade order is eased and the factory chain resumes normal operations.

Currently, seven of the top ten container ports in the world are located in China. Therefore, American logistics businesses are worried that the shutdown in China will affect their major shipping ports. Shelley Simpson, commercial director for JB Hunt Transport Services, said late last month that, despite “temporary relief” at US ports, things could turn out “a lot worse” this summer because of what’s happening in China.

Endless Congestion

According to a survey from Israel-based global maritime data company, Windward, there are about 412 global container ships still waiting to dock due to congestion, equivalent to nearly 20% of the total number of ships in and out this import and export point. The number of ships “stuck in ports” this month increased by 58% compared to February. On May 12, President Xi Jinping confirmed to all levels of government that they will “resolutely adhere to the “Zero Covid” policy. Up to now, China has at least 27 cities in a state of full or partial blockade. Thus, the congestion will surely continue and become worse in the next few months in China and other regions of the world.

According to the latest update from S&P Global Market Intelligence on April 25, the number of ships waiting at Shanghai port was 384, an increase of more than 27% compared to a month earlier. This creates great pressure on other Chinese ports, as ships try to find alternative ports to dock.

Goods piled up due to lack of trucks

When Shanghai officially applied the restrictions, the containers were stuck at the port for 15 days. Zhang Wei, Shanghai’s deputy mayor, admitted that since the lockdown was imposed, the city has always been in a state of “decreased freight efficiency and stagnant logistics”. This is reflected in the number of goods piled up at the warehouses and the number of containers on the waiting list for unloading and importing.

Transport congestion has led to shortages of imported raw materials. Many factories in China were forced to delay production due to lack of input materials and difficulties in transporting products to customers. Finished goods inventories increased rapidly and reached the highest level in about a decade.

Logistics giant Maersk said it will continue to raise rates if pressure on the supply chain persists. Now, Maersk’s average freight rates rose 71% in the first quarter compared with the same period last year.

Khanh Huyen Nguyen

Goods “stand still” at border gates before China’s announcement to stop customs clearance