HIGHLIGHTS:

- Foxconn chooses Malaysia to build a factory specializing in producing chips for electric vehicles.

- There are various reasons for this choice.

- The joint-venture is a part of Foxconn’s strategy.

FULL ARTICLE:

Apple assembler, Foxconn picked Malaysia as their place to manufacture chips

Foxconn’s Malaysian partner, Dagang NeXchange, said in a filing with stock exchange Bursa Malaysia that it had signed a memorandum of understanding with Big Innovation Holdings, a subsidiary of Foxconn. This memorandum is about setting up a joint-venture in Malaysia.

According to media reports, Foxconn and Dagang plan to construct a semiconductor factory for electric vehicles. This joint venture will build a fabrication plant specializing in the mature lechnologies of 28-nanometer and 40-nanometer process nodes, having the capability of producing up to 40000 wafers per month.

Many reasons behind the choice of Taiwanese assembler

Among the ever-changing political status on a global scale, “Goods made in Malaysia can sell in China, the U.S. and Southeast Asia free of political constraints.”, said Darson Chiu, a research fellow with the Taiwan Institute of Economic Research think tank in Taipei. He also noted that, “Manufacturing in Southeast Asia will not only lower the costs but also deviate from the U.S.-China competition and conflicts.”

The technological ability of Malaysia in South-East Asia is undeniable. This is one of the most vital factors as Foxconn can make use of the local technicians to kick off production.

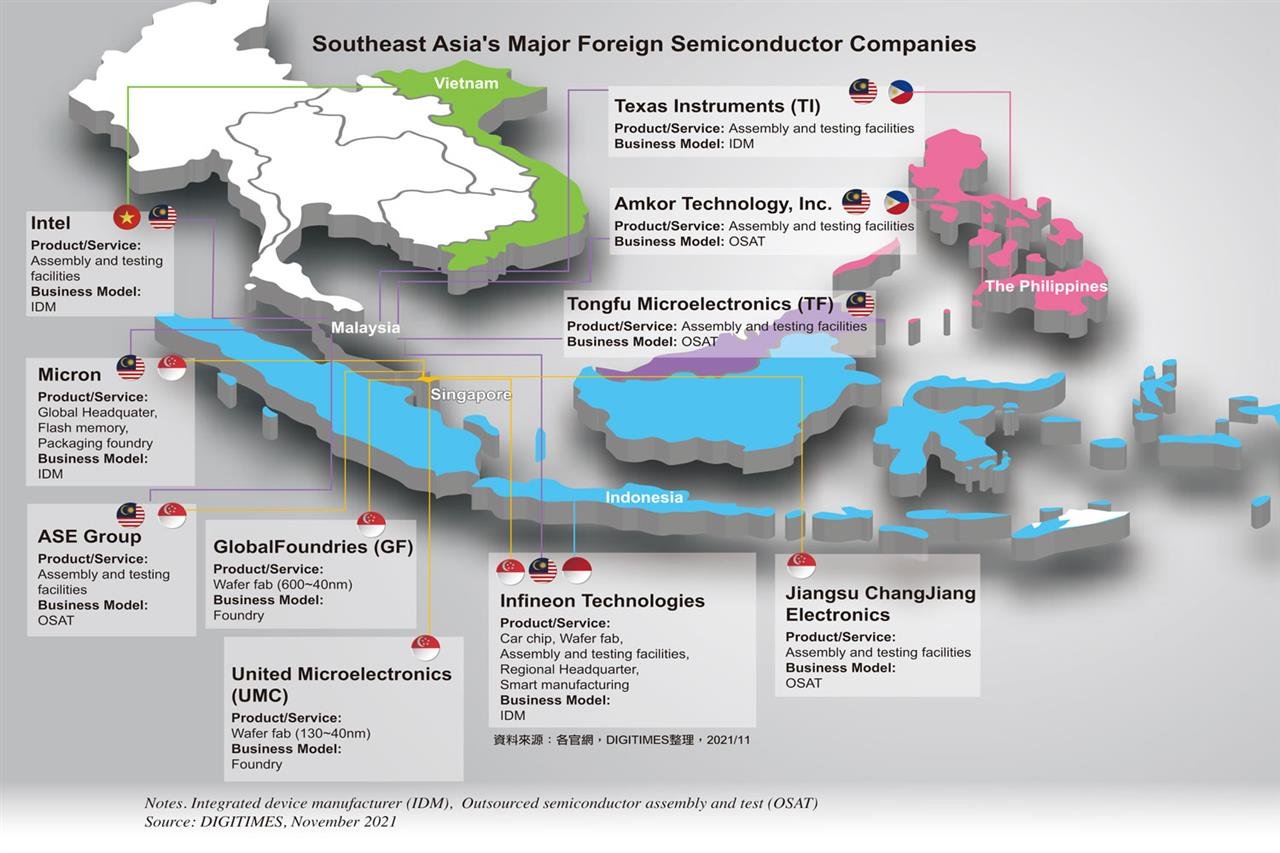

About 37% of Malaysia’s exports of goods comprise electrical and electronic products. This South-East Asian country also accounts for approximately 13% of the global capacity for semiconductor assembly, testing and packaging.

The bigger target of Foxconn

Foxconn’s decision to build a major semiconductors facility in Malaysia reflects the high priority being given by electronics firms to diversification of their supply chains for critical electronics components.

For a few recent years, Foxconn has shown intent to expand into electric vehicles through a series of joint ventures, for example Fisker, Geely, Stellantis or Gigasolar Materials. With many grounded evidence, the electric vehicles industry set to reach $957 billion worldwide by 2030 at a compound annual growth rate of 24.5% from this year.

Minh Hong