HIGHLIGHTS

- The price of iron ore for delivery in May 2022 on the Dalian Commodity Exchange increased by 5.3% to 671 yuan.

- China will implement new tax and fee cuts and front-load infrastructure investment.

- In addition, the price of iron ore in China jumped sharply when many steel manufacturers increased ore reserves.

FULL ARTICLE

Iron ore prices soar again

Closing the latest session, the price of iron ore for delivery in May 2022 on the Dalian Commodity Exchange, increased by 5.3% to 671 yuan (equivalent to 105.46 USD/ton). According to the consulting firm SteelHome, the spot price of iron ore containing 62% iron content in China fell 1 USD down to 108 USD/ton in the session on December 10.

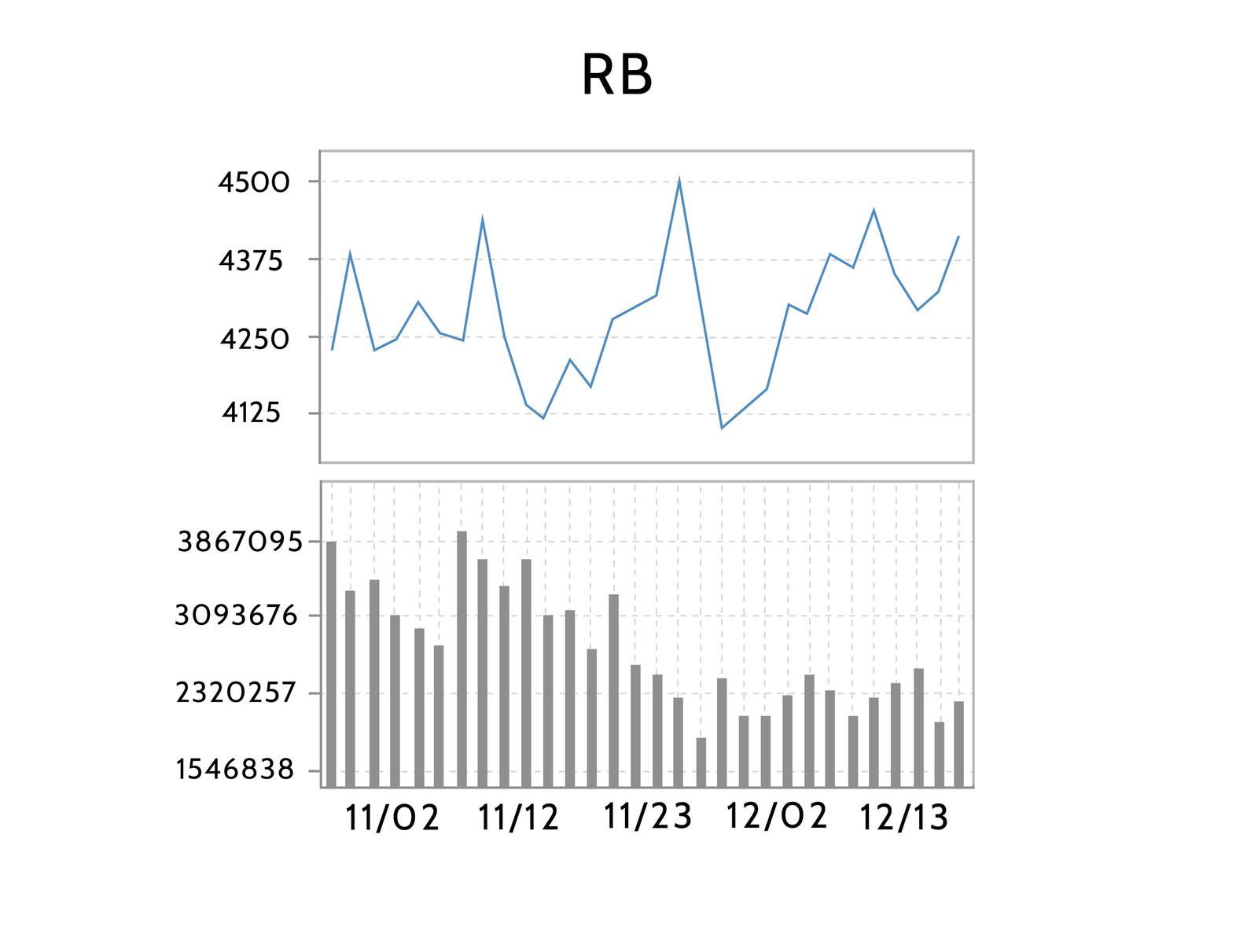

At the same session, the price of iron ore delivered in May 2022 on the Shanghai Exchange increased by 3 yuan (equivalent to 4,310 yuan/ton). Used construction rebar on this floor increased 1.6% (to 4,374 yuan/ton) and hot-rolled coil used in cars and household appliances increased by 1.4% (about 4,501 yuan/ton).

According to data from Mysteel, other steelmaking raw materials traded in a range as capacity utilization rates at blast furnaces with 247 mills continued to decline, falling to 74.12% last week.

The reason why iron ore prices bounced up

“The supply-side of iron ore is not expected to see big change next year, with shipments from mainstream miners to remain stable while output from domestic mines sees little change,” said Cheng Peng, an analyst with SinoSteel Futures.

With prudent monetary policy and proactive fiscal policy, China will maintain “a stable and healthy economic environment” next year. The world’s second-largest economy will implement new tax and fee cuts and front-load infrastructure investment, step up cross-cyclical policy adjustments and support key areas.

In addition, the price of iron ore in China jumped sharply when many steel manufacturers in this country increased ore reserves. Meanwhile, analysts say that China’s iron ore demand is still weak as investment in infrastructure development and real estate declines, keeping steel demand at a low level.

Thanh Thao

China: Exploding used luxury goods market