The new weapon of the giants – BATTERY

According to the research of Bloomberg NEF, battery price accounts for more than half (57%) of the production cost of an electric car. This is the reason why the battle of electric cars is also the battery battle.

Meanwhile, the demand for electric car batteries is constantly increasing and exceeding the production capacity of current factories. Wood Mackenzie, Energy research and consulting firm, estimates that electric vehicles will account for about 18 percent of new vehicle sales by 2030, which could lead to an increase for battery demand by about eight times their current production capacity. In addition, battery companies also compete with electricity manufacturers for tools to store excessive solar and wind electricity.

Therefore, current manufacturers prioritize reducing production costs by continuously improving technology as well as bringing production plants closer to automobile assembly areas to save transportation costs. In the long term, the crux of the battery industry is to replace the liquid lithium at the core with solid lithium compounds. Because the solid ones will be more stable and less overheating, allowing the battery to charge faster. Currently, there are many companies that have mastered this technological process like Toyota Motor, but the solution for mass production at a reasonable cost is not an easy one. Hence, the path to electric car battery supremacy is challenging and time-consuming.

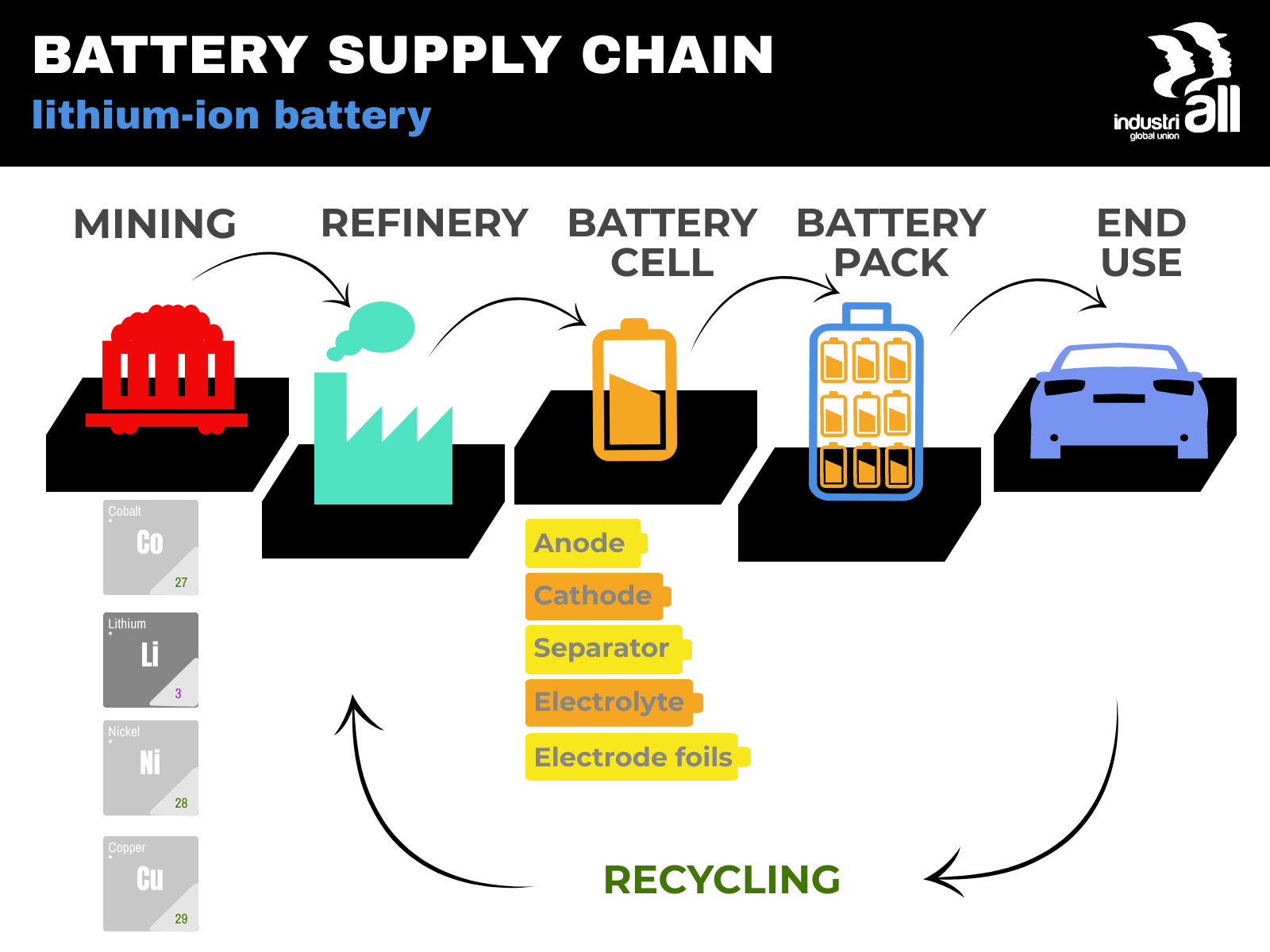

So let’s delve more about the current supply chain of this powerful weapon, the lithium-ion battery, which is the most-used type?

Who had advantages in the Supply chain of electric car batteries?

Raw Material Mining

The main components of lithium-ion batteries include lithium, aluminum, cobalt, graphite, manganese, and nickel. According to the US Trade Commission, these materials constitute more than half the cost of the finished battery. Amongst these, lithium, graphite and cobalt are three materials that are facing serious supply shortages.

For lithium, battery demand accounted for 14% of lithium production in 2015, and this figure is forecast to climb to 38%, causing a shortfall of about 100,000 tons by 2025. This will push up the price of lithium, more and more escalating. At the present, Chile and Argentina are the two leading exporters of lithium in the world.

Next is graphite, which is used in the anodes of many electric vehicle batteries. The quantity of graphite used in batteries has increased from 80,000 tons in 2015 to 250,000 tons in 2020. It is known that China is currently the world leader in graphite, followed by India and Brazil.

Finally, cobalt, on average, makes up about 30% of the cathode of a lithium-ion battery (2017), but in the future, manufacturers will reduce the cobalt content as the battery becomes thicker. Currently, crude cobalt supply is concentrated in only a few countries such as the Republic of Congo, which accounts for more than half of the world’s production (2016), followed by China and Canada. In addition, China is the main source of refined cobalt (cobalt is refined before the production process). With increasingly severe scarcity, the gap between cobalt supply and demand is expected to be as much as 20% by 2025. It is widely known that the price of cobalt increased sharply by 120% in 2017, then became more stable in the period from 2018 to now with the help of futures contracts.

Battery production

The battery manufacturing process can be divided into three stages: cell battery, battery module and battery pack. These processes can take place in one location or in many different locations with many stakeholders.

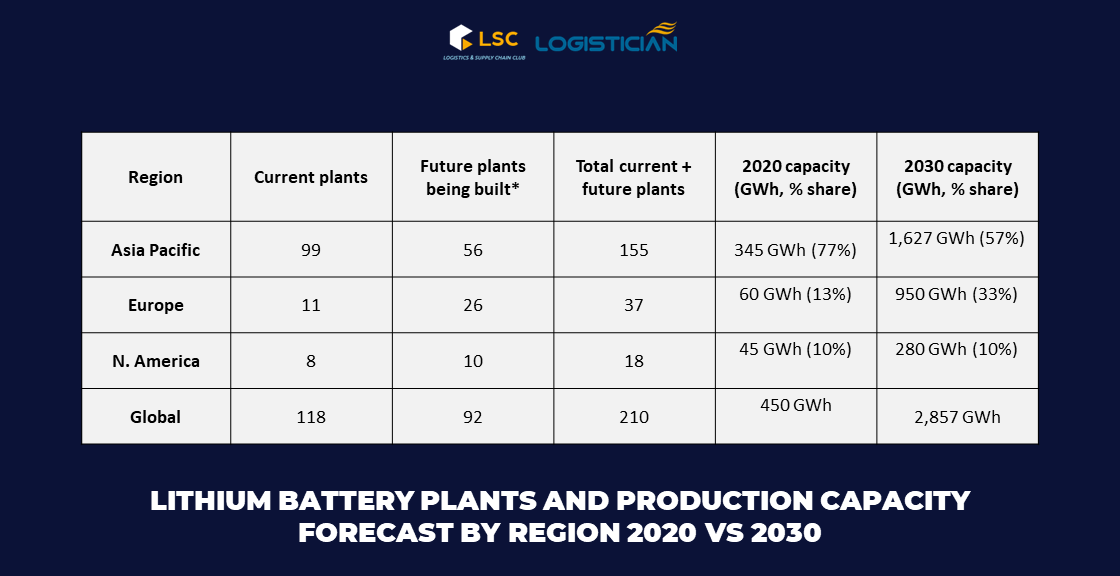

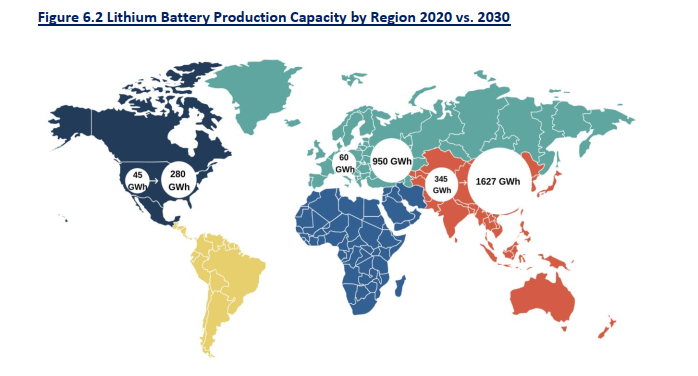

Overall, battery cell manufacturers are considered as one of the most powerful entities of the supply chain, as being the most important process in the lithium-ion battery manufacturing. Currently, Asia accounted for about 77% of cell battery production capacity and this dominance is expected to continuously grow. Notably, 44% of current production capacity is controlled by Chinese companies. Meanwhile, production capacity in Europe and North America recorded a smaller share, respectively 13% and 10%. According to ABB’s forecast, by 2030 Europe will increase its share of capacity to about 33% of global output, while N.America’s output will remain unchanged.

According to ABB’s EV Battery Supply Chain Report, the world’s largest battery cell manufacturer is LG Energy (Korea), which performs OEM orders for many big car manufacturers such as FCA, Ford, Greely, GM, etc. Hyundai, Nissan, Tesla,… followed by BYD (China), Panasonic (Japan), CATL (China) and SK Innovation (Korea). It is known that most of these enterprises are expanding production globally to expand production capacity. In this race, we also see a representative from Vietnam, Vinfast, which has just announced the construction of a cell battery factory in Vung Ang Economic Zone (Ky Anh, Ha Tinh) with a total investment of more than 8,814 billion VND.

Cell batteries then will be combined together into battery modules. Different modules are made up from different compositions and various numbers of battery cells. This stage is estimated to account for 11% of the total battery production cost.

Finally, the modules will be combined together to form a “battery pack”. The complete battery pack includes many battery modules along with battery management systems (BMS) and cooling systems (Thermal Management Systems). This stage will be done manually or with the help of automatic robotic arms, estimated to take up 14% of the battery production cost. . The complete battery pack is usually processed near the automotive assembly plants, to save transportation cost.

For example, the EV batteries used in the Nissan Leaf have cells and modules manufactured at the Energy Supply Corporation (AESC) Plant in Sunderland, UK, and then shipped to Spain for assembling the battery pack. On the other hand, Tesla’s Module 3 cars have batteries that are produced centrally at the “Gigafactory” in Nevada.

The race to regain equilibrium

As mentioned above, Asia currently accounts for 77% of global battery production capacity, while China alonely accounts for 44%. In the context of the Covid-19 epidemic, giant economies are fully aware of the dangers of one-sourced supply chain.

The Chinese government considers batteries as an important factor in its ambitions to dominate the electric car industry. The government has continuously subsidized Contemporary Amperex Technology Company to become one of the world’s largest battery suppliers. Currently, China is the country that owns the most advanced and economical lithium-ion battery production technology.

Facing this situation, the Biden administration quickly launched a National Strategy, aiming at increasing production capacity of electric car batteries and semiconductors as well. The goal of this program is that the US can self-process everything from mining to battery production and recycling by the end of the decade. Reportedly, the United States Department of Energy, plans to allocate $17 billion in loans to the electric vehicle manufacturing sector, mainly investing in new battery technology.

Europe is also no exception to this battle. The European Commission announced a 2.9 -billion Euro fund to support battery production and research. Part of this was funded for Tesla, because of its decision to build a factory near Berlin. Freyr, a Luxembourg battery maker, has planned to raise $850 million, partly for a merger with Alussa Energy Acquisition Corporation. The company plans to manufacture batteries using technology developed by 24M Technologies in Cambridge, Massachusetts. Meanwhile, North Volt (Sweden) will build a battery factory with a capacity of up to 150GWh. Volkswagen (Germany) and Mercedes-Benz are also planning the construction of battery factories.

When the danger is on the verge, the survival instinct will arise, which leads to action. As we can see, every country has prepared and joined the battle. But no one can be sure whether these measures can change the one-sourced supply chain of electric car batteries or not, especially when everything is difficult?

Huyen Tran