HIGHLIGHTS

- According to Ms. Alicia Garcia-Herrero, limiting chip supply raises electrical device product prices. Furthermore, the global supply chain’s industrial and security activities have been disrupted.

- Listening to the “call” from the demand side, the global semiconductor industry has had two reactions. The first step is to increase capital spending.

- Second, the governments of various major economies have launched significant spending projects in an attempt to manufacture chips in the country.

FULL ARTICLE

Causes of rising demand and a shortage of semiconductors

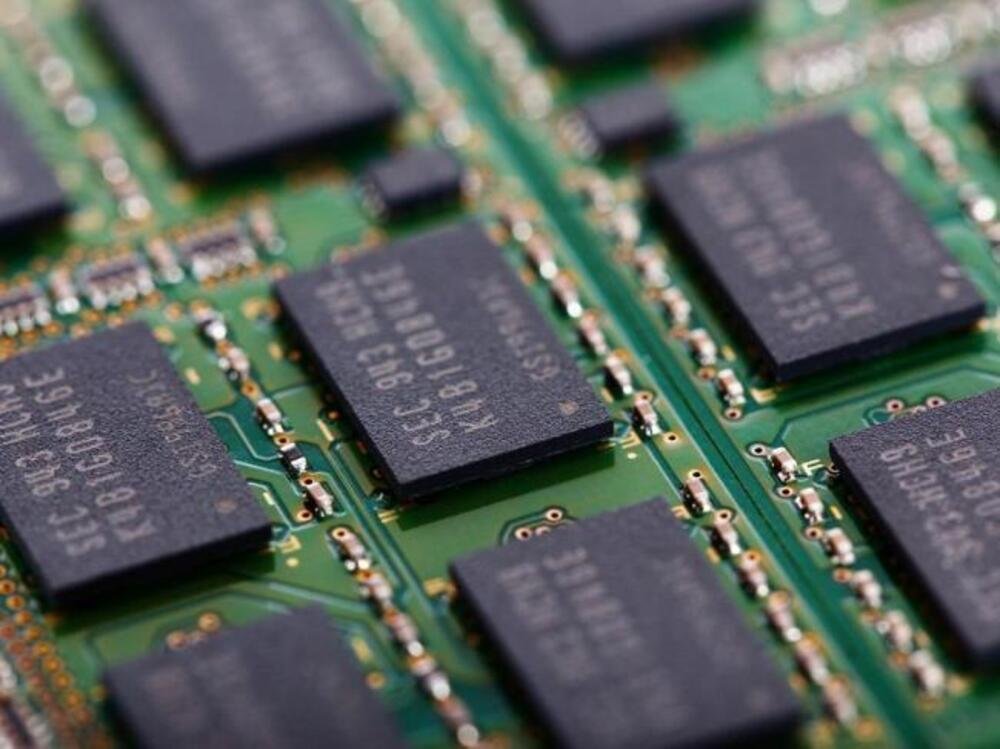

Recently, Alicia Garcia-Herrero, chief economist for Asia-Pacific at Natixis and senior research fellow at Bruegel, a Brussels-based consultancy, provided the analysis about the state of the semiconductor chip. Specifically, the limited supply of chips caused the price of electronic devices to rise. In addition, there are disruptions in industrial operations and the security of global supply chains. Accordingly, she gave two main cyclical and structural reasons for the sharp increase in demand for semiconductors.

Firstly, cyclically, the demand for electronic products increases sharply because so much manufacturing and education activities have to move online. Moreover, the disruption of the semiconductor chip supply chain in the global market due to the stockpiling of goods during the pandemic also caused demand to increase.

Structurally, as electrification progresses, the production of electric vehicles desperately needs semiconductors. The majority of them are high-end semiconductor chips that can only be manufactured at the most advanced facilities, such as those in Taiwan.

The global semiconductor industry’s reaction

Listening to the “call” from the demand side, the global semiconductor industry has had two reactions:

The first step is to increase capital spending. Taiwan Semiconductor Manufacturing Company (TSMC) has raised its capital expenditure from 30 billion USD in 2021 to 44 billion USD in 2022 in expectation of continued high worldwide demand for semiconductors.

Second, the governments of several major economies have implemented massive spending programs to try to increase domestic chip production. In particular, China has established two large funds in a row to support the domestic semiconductor industry. The total investment capital of this country is planned to be about 50 billion USD.

Semiconductor Manufacturing International Co (SMIC), China’s largest semiconductor business, invested an average of $4-5 billion in conventional chips between 2019 and 2021. United Microelectronics, based in Taiwan, also announced a 66 percent rise in capital spending by 2022. Recognizing the potential of the semiconductor chip market, the United States and the European Union have invested tens of billions of dollars in the industry.

Aside from the two responses, another “route” in the semiconductor business is foreign development of greenfield projects or acquisitions made by prominent chipmakers.

Finally, Alicia Garcia-Herrero predicted that chip shortages would lessen marginally by 2022 and that supply would be more plentiful by 2023. This also implies that an oversupply issue is possible in the near future. High-tech chips, on the other hand, will remain scarce.

Huyen Tu