HIGHLIGHTS

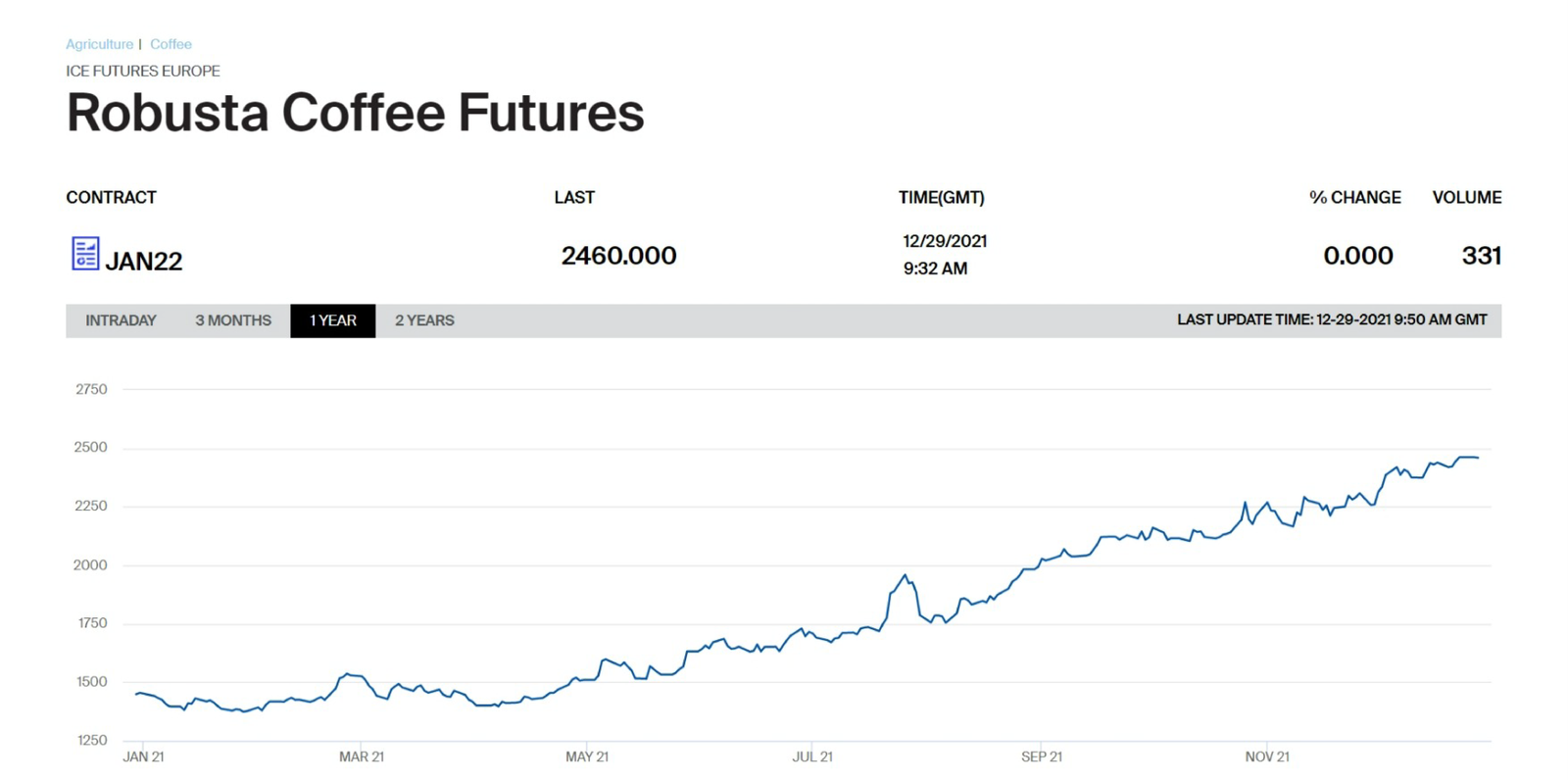

- At the session on December 29 on the Ice Futures Europe, Robusta coffee futures prices in January 2022 reached $2,463/ tons, which is the highest price in a decade since August 2011.

- The main cause is supply disruption, including extreme weather conditions, port congestion, shortage of workers, etc.

- Rising commodity futures prices mean that coffee prices are likely to become more expensive in the future.

FULL ARTICLE

Commodity futures prices peaked

Robusta coffee futures prices continuously increased in 2021. In which, at the session on December 29 on the Ice Futures Europe, Robusta coffee futures prices in January 2022 reached $2,463/ tons, which is the highest price in a decade since August 2011.

Traders say that in Vietnam, the world’s top robusta coffee producer, more than 60% of coffee production has been harvested in dry weather. However, disruptions in the supply chain and abnormal fluctuations in fertilizer prices have increased the demand for buying to stockpile this commodity. Specifically, the amount of coffee stocked at the warehouses of the IEC floor on December 22 was only 99,190 tons, down from 109,040 tons a month earlier.

Difficulties piling up difficulties

Coffee is grown mainly in tropical climates, where the weather conditions are extremely harsh. This factor pushed the price of coffee up.

In Brazil, which accounts for a third of global coffee production, prolonged droughts coupled with severe frosts have pushed coffee prices up dramatically. According to Conab, Brazil’s agricultural forecasting agency, the country’s output of the country’s most consumed coffee, Arabica, is down nearly 40% from last year. Besides Brazil, Colombia, the world’s second-largest supplier of Arabica, has experienced excessive rain, which also has a relatively large impact on the growing conditions of coffee trees.

In particular, the Covid-19 wave has brought with it numerous challenges in the supply chain, such as port congestion or lack of workers, high raw material prices and long transit times, which also contributed to the increase in coffee prices. Meanwhile, planting and harvesting additional coffee trees takes several years.

Who is the bearer?

Rising commodity futures prices mean that coffee prices are likely to become more expensive in the future. In fact, the price of coffee in the US has increased 7% in the past year, according to the US Bureau of Labor Statistics.

According to David Ortega, Michigan State University Associate Professor who focuses on agribusiness, coffee is a commodity that can be stocked, so it will take some time for us to see clearly that the ‘burden’ of rising raw material prices will shift to cafes and shops. For example, Starbucks in July 2021 said it bought coffee 12 to 18 months in advance.

“The effects of the pandemic are already showing in the prices of some goods, but most of those price increases will be passed on to consumers’ wallets,” he added.

Minh Ngo

Coffee supply crisis, Arabica beans become scarce